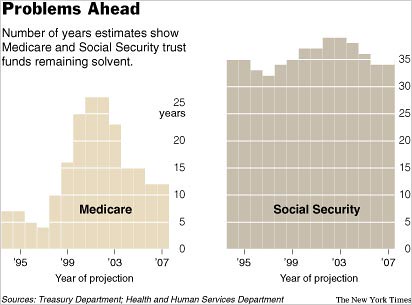

I've invented a new unit of time, the Samuelson Unit, which is the length of time required for the Social Security system to become 'bankrupt.' Oddly enough, Social Security is always DOOMED roughly 34 years from the time of the estimate. In other words, Social Security is doing fine, and will continue to be solvent. Today, the NY Times had a pretty picture illustrating the Samuelson Unit in its full glory*:

Notice that the estimate every year has been that Social Security will be unable to meet its benefits 30-38 years out...for the last fourteen years. Got it? I loves me my Samuelson Unit**.

*You people are sick. I'm not referring to his equatorial regions.

**Again, you people are sick.

- Log in to post comments

More like this

Tristero has an interesting multiple choice exam for everyone. I have a minor problem with one answer, however (italics mine):

(B) Advocating the privatization of Social Security as a means of resolving a very real but overblown problem - as favored by the Bush administration and conservatives in…

The NY Times asks about Peter Peterson, "Can the co-founder of the Blackstone Group who has scored riches from a controversial tax break emerge as a credible voice in favor of fiscal constraint in Washington?" Of course, he can. He just has to be clever about what he means by "fiscal constraint…

Over at Corrente, Joe Firestone provides details about one of the many false arguments about the Social Security 'crisis'--the claim that Social Security is DOOOMMMEEEEDDD!!! is based on incredibly pessimistic and historically unwarranted assumptions about GDP growth (italics mine):

Second, the…

So Ezra Klein, along with many other progressives, has been offering alternatives to the Republican call for the slash-and-burn of Social Security. But what's annoying about all of this is that the prediction that Social Security revenues plus the accumulated U.S. securities (yes, the U.S.…

I think that the tag "Fucking Morons" is highly inappropriate. The future of Social Security is a complex issue involving demographic and economic projections that experts don't all agree about, and economic concepts that aren't at all obvious. It's not that I disagree with your main point, that Social Security finances are in better shape than most people think and only (relatively) small changes are needed. But the analysis is complicated whereas "Fucking Morons" is just name-calling. That's great for a rabble-rouser like Atrios, but I'm hoping that ScienceBlogs has higher standards.

For an example of how the issues are actually complicated, not simple, in your post Framing Social Security, you talk about "liquidating" the debt without actually considering what that means. How would the Treasury Department pay the SSA? They can raise taxes, sell more bonds, cut other government spending, or--hopefully not a real option--just print money and cause a hyperinflation. Notice how these are exactly the same options that would exist if there were no Social Security trust fund. The trust fund is an accounting concept, not an economic one. Sure, the Social Social Security Administration can keeping paying benefits until 2041. But all that means is that the problem is transferred to the Treasury Department. You still have to pay the bills. And this accounting concept only keeps SSA "solvent" until 2041.

And you say "For even marginal tax or benefit alterations, the economy has to grow at a rate about 20% lower than the average U.S. historical growth rate... for forty years straight." And what makes you think that's unlikely?

For a table of different countries real, per-capita GDP growth rates of over the last few decades, see here.

And the long term trend for productivity growth is downward:

Total Factor Productivity Growth Rate (dA/A)

1950s 1.4 percent

1960s 1.4 percent

1970s 0.1 percent

1980s 0.5 percent

1990-1995 0.6 percent

Yes, there's a recent blip upwards, probably because of computer technology, but will that be sustained? Who knows? What will happen to productivity growth if energy prices quadruple? Who knows? There's a reason that long-term projections are required to use conservative estimates of growth. No one knows what will happen over the next forty years.

Social Security is arguably in good shape, but a little humility is in order. Dith the "Fucking Morons" label.

Fine. SS is not doomed.

Can I have my money back anyway?

On the other hand Medicare insolvency predictions have gone from 25 years to 12 years over the past 5 years. So by your logic Medicare is doomed. And isn't it possible policy changes have something to do with changing Social Security insolvency predictions? Just my two cents.

Noturus,

Medicare is in trouble, but that's because the payouts are rising very quickly due to high rates of healthcare inflation. I don't know what you mean by "policy changes." If you mean that someone is fudging the numbers, no. The Board of Trustees is mandated by law to use certain parameters in their estimates. It really is just plug and chug. Social Security has been in trouble in the past, and that was remedied by SS taxes in the 1980s (actually, it's not clear if SS was in trouble. Both Democrats and Republicans want to offset the Reagan income and corporate tax cuts by increasing SS revenues).

Michael, in one word: No. Like all taxes, consider it a user fee for what we in the reality-based community like to call "society and infrastructure".

In two words: Sod Off.

I don't mean fudging the numbers, I mean things like changing the benefits paid out.

Another thing, if its plug and chug (and I'm not saying it isn't) why do the figures refer to trust funds? I thought the whole idea of insolvency was that since current taxes pay for current benefits there was going to be a point (after the Baby Boomers retire when the demographics collapse the whole thing like the pyramid scheme that it resembles.

How does the Samuelson unit account for changes over the last 14 years, such as increases in the elegibility age, that have improved SS's status? Also, I would not consider the 1980 SS taxes and the resulting trust fund IOUs a remedy for anything unless we have a clear understanding of how those trust funds are to be redeemed. All they do is shift the burdon from the SS system to the general revenues.

I don't mean fudging the numbers, I mean things like changing the benefits paid out.

Another thing, if its plug and chug (and I'm not saying it isn't) why do the figures refer to trust funds? I thought the whole idea of insolvency was that since current taxes pay for current benefits there was going to be a point (after the Baby Boomers retire when the demographics collapse the whole thing like the pyramid scheme that it resembles.