“Well, this is a thing unheard of. An Elf would go underground, where a Dwarf dare not. Oh, I’d never hear the end of it.” -Gimli, Lord of the Rings

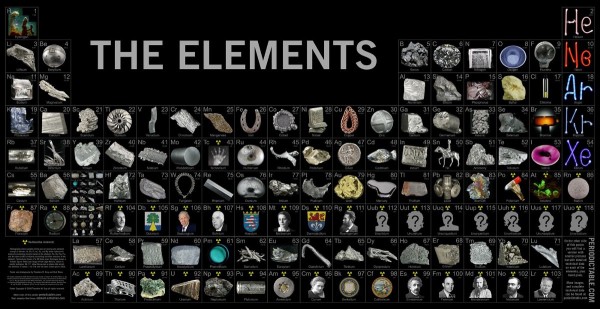

When you think about the different elements present here on Earth, I hope you think about the different ways they bind together, combine, and add value to all we do. Extracting them is a great difficulty, as Uncle Tupelo will sing to you in their song,

Image credit: Theodore Gray, via http://theodoregray.com/periodictable/Posters/index.posters.html.

Image credit: Theodore Gray, via http://theodoregray.com/periodictable/Posters/index.posters.html.

For each pure element, there's an abundance in our Solar System that's relatively consistent across where we look, with only the gravitational gradient in our Solar System's formation responsible for the differences.

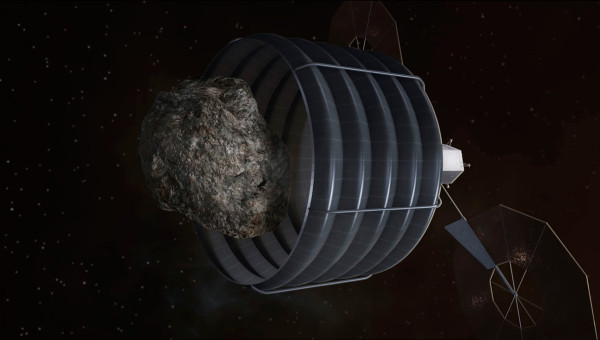

However, our Earth is huge and differentiated, and even our richest mines pale in comparison to another location: just beneath the surface of asteroids.

Image credit: NASA, via http://www.jpl.nasa.gov/news/news.php?release=2013-131.

Image credit: NASA, via http://www.jpl.nasa.gov/news/news.php?release=2013-131.

Could asteroid mining pave the way to riches from space in our future? Enjoy thinking about this for our weekend diversion!

- Log in to post comments

Mining asteroids makes sense because it is in space, not because of the material itself. Putting stuff outside Earth gravity is what's very expensive, not mining.

Also, that cost estimate of 2-3 billion for an operation where an asteroid is diverted to lunar orbit and raw material extracted, refined and pure metal hauled to a useful location (e.g. Moon base or space station), uh, that's a joke, yes?

That is a lot to think about. How does one ' capture ' an asteroid in the first place? I would guess tag along with it at its own velocity, settle onto it (in the same fashion as our comet capture), strap on a few retro boosters to slow it down, then start to change its trajectory to head it (fly it) toward the moon & orbit.

Gosh! That would take a lot of energy (fuel, cost) and time. I wonder who would fund such a venture ? (plug for Virgin ??) (the world bank ??)

What effect would an order of magnitude increase in platinum production have its price? Assuming of course you can get it back to Earth. How many kilos of re-entry vehicle would you need to get into orbit to deliver a kilo of payload back to sea level at a reasonably well defined location?

I can't imagine this would be a free-for-all with the physical supply and economic demand dictating the price. At least not at first; the folks who invested in bringing the rock into orbit are going to 'own' it and control the rate of mining. So assuming for giggles that the scenario took place, I imagine the situation with platinum would be similar to the situation with diamonds today: the few companies in control of the supply would control how much goes to market in order to keep the price point where they wanted it.

The answer is simple. And it's the same reason the UK housing crisis won't be solved by making it easier for private industry to make more homes:

THE WILL NOT DEPRESS THE MARKET. They will produce some, but not so much that they reduce the market price.

Hell, that;s the reason there are over 600,000 unoccupied private tennancies in the UK: the price for it isn't enough, so they save cost and stop reevaluation of their "investment" to a lower price by letting it stand empty.

Platinum production won't be enough to upset the market. If nothing else, the current incumbents will stop it (See De Beers and diamonds for an example).

Monetary cost is not the proper way to look at this type of endeavor.

It should be viewed from a resources (output vs input) perspective.

If it cost x amount of man hours and x amount of raw materials but overall will net a return of more resources both physical and knowledge base that benefits mankind overall.

Then you base your decision on that.

"They will produce some, but not so much that they reduce the market price".

That is a possible scenario, but sidesteps the question. What effect would an order of magnitude increase in platinum production have its price? The answer is it would severely depress it. Sure the "owners" of the asteroid would try and maximise their return, but that does not mean simply keep prices high. Some investors would want jam today rather than gambling on making their grandchildren very rich, provided of course some other supplier does not turn up and spoil their party. Others might see slashing prices to put every terrestrial producer of platinum out of business before exploiting their monopoly as the best way forward.

Diamonds may be an example where very tight control of essentially a single source of supply keeps prices high. Pick almost any other commodity and supply and demand (often destabilised by speculation) rules. Think of gold prices over the last forty years, even scrap metal over the last ten.. Compare oil prices now (even before the Iranians start to dump theirs) with what they were when OPEC had a De Beers type stranglehold on supply. So I'm certain that not only would a ten-fold increase in production depress the market, but the knowledge or suspicion that some organisation had the power to dump that much platinum onto the market at short notice would make holding stock a very risky business. Prices would be unstable, and riding a see-saw with a bottle of nitroglycerin would be less risky to the holder's well being than holding platinum futures.

Odd definition of sidestep. Answering it.

None. Why? Because it wouldn't be allowed to happen.

Well no, AFAIK most for-profit corporations do not invest funds into endeavors with the purpose of "benefit mankind overall." They do it because they perceive a positive potential ROI. They must also consider opportunity costs, which means that even if asteroid mining has a positive ROI, nobody's going to do it if there is an alternative they can do which has a more positive ROI.

Yes there would probably be an initial spike downwards. But again I think you have to consider the real world example of diamonds. They could be dumped at any time, yet AFAIK they are not considered a highly fluctuating or particularly risky investment. There is investment in them, just as there would be investment in metals even with asteroid mining, for two reasons. (1) Iinvestors don't merely consider potential corporate behavior, they consider actual corporate behavior too. When that actual corporate behavior is relatively stable, they will consider the product a relatively stable investment. (2) When behavior isn't stable or predictable, conservative investors will indeed forsake that market just as you say...but it will then attract investors that like a lot of short-term risk/fluctuation with its potentially high payoffs.

There is nothing big about this . Gravity gradient can move even planets and galaxies . Why be so surprised about moving asteroids . It's a small scalar wave effort . Also the periodic table is all wrong . The elements that can be created out of vacuum energy are infinite . We need to start thinking in a fresh way .

Nobody is surprised by asteroids moving. What's surprising me is why you claim otherwise.

And what is a "scalar wave effort"?

Also no, your "idea" on elements is bullshit. Sorry. It's not even wrong. It's "The earth is shaped like thursday" wrong.