“Mistakes can be corrected by those who pay attention to facts but dogmatism will not be corrected by those who are wedded to a vision.” -Thomas Sowell

It's hard to believe, but it's already almost time for spring! After leaping an extra day to help keep our calendar in synch, March started off with an amazing string of stories over at Starts With A Bang, including:

- Why are maps of the cosmos oval-shaped? (for Ask Ethan),

- A new hope for our galaxy's next supernova (for Mostly Mute Monday),

- Why college is so expensive, and how to fix it,

- The mystery of fast radio bursts deepens: they can repeat,

- The dark side of the Universe (a live-blog event of a fantastic Katie Freese talk),

- Hubble shatters the cosmic distance record, and

- Why does Earth appear blue from space?

For those of you hanging around the pacific northwest, I’ll be giving a public talk in Portland, OR on Tuesday, March 8th, and if you have questions you want me to ask to the Principal Investigator of LIGO, drop them off in the comments; I'll be interviewing him on Tuesday! But for right now, let's get into the bonus science of the week, and jump on into our Comments Of The Week!

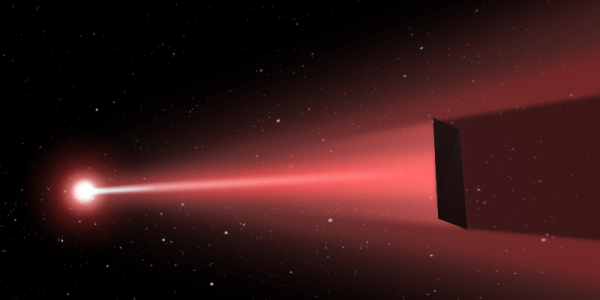

Image credit: the DEEP-laser sail concept, via http://www.deepspace.ucsb.edu/projects/directed-energy-interstellar-pre…, Copyright © 2016 UCSB Experimental Cosmology Group.

Image credit: the DEEP-laser sail concept, via http://www.deepspace.ucsb.edu/projects/directed-energy-interstellar-pre…, Copyright © 2016 UCSB Experimental Cosmology Group.

From the incredulous Waterbergs on the proposed laser array to accelerate spacecrafts using a laser sail: "I think the maths has gone a little wrong here. You state that a laser in the gigawatt range would require an area of 100 square km. This implies a power of just 10 watts per square meter – massively below where we are at present – in fact by about a factor of a thousand at least. So actually the area required would be a rather small fraction of a square km, maybe just 100m by 100m – quite doable."

Sure, if we use conventional, optical lasers that take advantage of terrestrial power sources you're absolutely right. Is that what this project is proposing? You could read the white paper I linked to, and find the following relevant parts inside:

This approach also eliminates the conventional optics and replaces it with a phased array of small optics that are thin film optical elements. Both of these are a follow on DARPA programs and hence there is enormous leverage in this system. The laser array has been described in a series of papers we have published and is called DE-STAR (Directed Energy System for Targeting of Asteroids and ExploRation). Powered by the solar PV array the same size as the 2D modular array of modest and currently existing kilowatt class Yb fiber-fed lasers and phased-array optics it would be capable of delivering sufficient power to propel a small scale probe combined with a modest (meter class) laser sail to reach speeds that are relativistic. DE-STAR units are denoted by numbers referring to the log of the array size in meters (assumed square). Thus DE-STAR-1 is 10 m on a side, -2 is 100 m, etc. Photon recycling (multiple bounces) to increase the thrust is conceivable but it NOT assumed. The modular sub systems (baselined here at 1-4 m in diameter) fit into current launchers such as the upcoming SLS and while deployment of the full system is not our goal in the short term, smaller version could be launched to test proof of concept. As an example, on the eventual upper end, a full scale DE-STAR 4 (50-70 GW) will propel a wafer scale spacecraft with a 1 m laser sail to about 26% the speed of light in about 10 minutes (20 kg_0 accel), reach Mars (1 AU) in 30 minutes, pass Voyager I in less than 3 days, pass 1,000 AU in 12 days and reach Alpha Centauri in about 15 years.

So, sure, we could bring up our optimal laser technology and the power source for it, but that has the drawbacks of being heavy, expensive, and not rechargeable. Or we could set up a solar-powered, renewable system, which is still incredibly expensive but at least has a chance. Size isn't the issue: cost and manageability is. That's why the choices are the ones that have been made. It's still not happening anytime soon, but it's the best chance we've got with this new technology.

From SelfAwarePatterns on the two merging black holes from one star possibility: "Hmmm. I didn’t realize that GRBs that come from stellar collapses only come from a supernova (or hypernova) remnant collapsing into a black hole. I mistakenly assumed that any stellar collapse would generate the GRB. Interesting. Thanks. I stand corrected."

It's not that a GRB in general can't come from something like two merging neutron stars; they can and are expected to, in fact. But the big issue is that if you want two black holes of ~30 solar masses each to come from a single star, you need a star whose destined-to-collapse core is at least that massive. And that means going over ~100 solar masses, easy, which really restricts what you can have.

But in general, I wanted to highlight this comment for something even more important; that last part:

I mistakenly assumed [...] Thanks. I stand corrected.

A willingness to be wrong. A willingness to learn. A willingness to accept new evidence/information and grow. This is why -- I like to think -- we're all here. So thank you for that moment of fulfillment, SelfAwarePatterns; I appreciate it greatly.

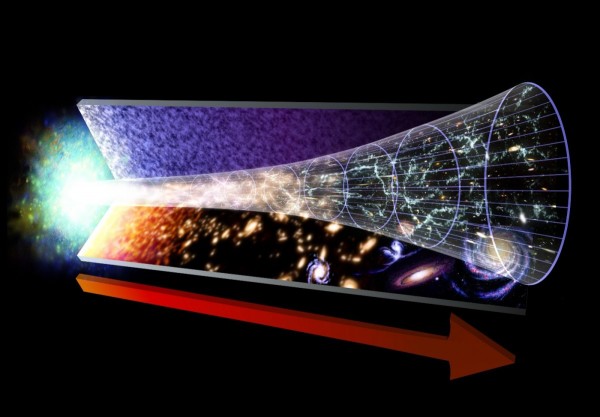

From Mark Slater on the Universe's acceleration (kind of): "Before the big bang the whole universe was filled with hydrogen atoms. "

Oh my, no. This is a nice idea -- the kind of idea you might have imagining what's possible -- but the kind that immediately falls apart when you try and confront it with testable propositions. Were these atoms neutral? If so, how did it survive the hot stage, and how do you account for the observations of Big Bang nucleosynthesis. If you want this to be a "well it was filled with hydrogen atoms, but then the Big Bang occurred," then how do you explain all the successes and predictions of cosmic inflation, as well as the initial conditions of the Big Bang?

The difference between science and faith is that science is not only based on evidence, but that when we get new evidence or the evidence changes, our conclusions change, too. If you're following a scientific process in your thinking, your conclusion -- in your case, the thesis you started with -- will change as you learn more.

Image credit: NASA, ESA and Jesœs Maz Apellÿniz (Instituto de astrofsica de Andaluca, Spain). Acknowledgement: Davide De Martin (ESA/Hubble), of the nebula NGC 6357 and the star cluster Pismis 24 inside.

Image credit: NASA, ESA and Jesœs Maz Apellÿniz (Instituto de astrofsica de Andaluca, Spain). Acknowledgement: Davide De Martin (ESA/Hubble), of the nebula NGC 6357 and the star cluster Pismis 24 inside.

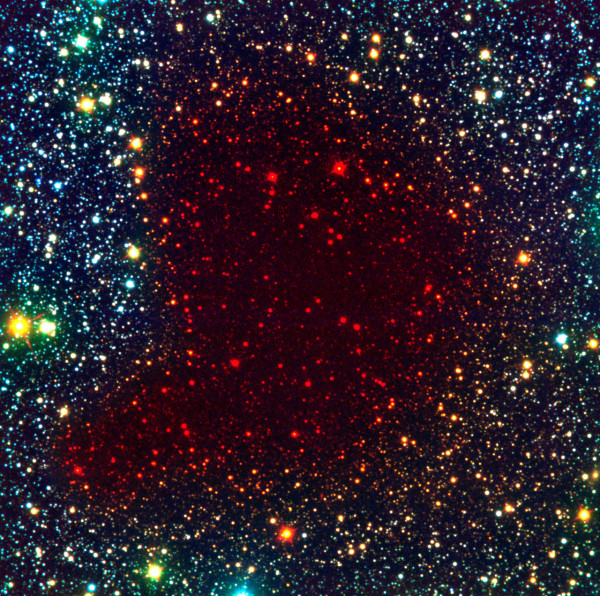

From Denier on the future of star formation: "Every time a read an article like this that talks about peaks and decline, there is always a little part in the back of my brain that thinks for a moment ‘star formation peaked 10 billion years ago and we’re running out of the stuff to make new ones? WTF are we going to do?’"

If you want to do something about it, may I suggest "hydrogen collection." You see, even though the star formation rate has been dropping (and will continue to drop) for billions of years, our Universe, by number of atoms, is still well over 85% hydrogen: somewhere around 88% or so. Considering it began as 92% hydrogen, very little has changed. (The change is more significant mass-wise; we're down in the 60-somethings percent-wise.) The key, if you want to do something, is to figure out how to gather and burn this hydrogen to completion. Gravity will help, as this bok globule -- currently just mostly molecular hydrogen -- will someday collapse to form a low-mass, isolated star.

Right now, this contribution to the star-formation rate is negligible, but in perhaps quadrillions of years, it will be the dominant component. Star formation will not cease altogether in hundreds of trillions of years, but will continue at a slower pace. My estimates tell us that we have some ~10^18 years of lower rates of -- but not a rate of zero -- continued star formation, which means we have many millions of times the current age of our Universe where Milkdromeda will still have stars undergoing nuclear fusion. It's not an answer to the "forever" problem, but pushing star formation out by another factor of 1,000 in time over what some naive extrapolators predict should help ease your mind a little.

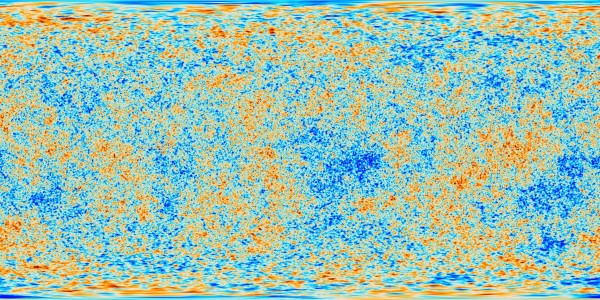

Image credit: ESA and the Planck Collaboration, of the CMB in a Cartesian frame, distorting the areas around the poles significantly.

Image credit: ESA and the Planck Collaboration, of the CMB in a Cartesian frame, distorting the areas around the poles significantly.

From Sinisa Lazarek on projections: "Projections can really mess you sometimes. i.e. in Mercator projection (most widely used for earth).. Greenland as huge.. as big as Africa… when in reality it’s only about the size of Egypt."

I like the Mercator projection of the CMB, above, to really emphasize how bad the area distortions are around the poles. The typical sizes of the red-and-blue spots at the equator and towards the poles are actually the same as one another, which gives you an idea of the catastrophe of this projection.

I'll also share with you my favorite Mercator projection story of all. Typical maps of the world for many decades looked like this:

Where the defined "longitude = 0," thanks to England, appears at the center. Note how a country like Russia appears discontinuous, as this is just the way longitudes line up on Earth. Other countries took to placing their country at the center of the longitude mark, but I was absolutely shocked when I took geophysics in college and had it taught by a French professor. His map of the Earth had France -- most of France, I should say -- all the way on the left-hand side, while the right side picked up again with the western tip of Africa and Iceland. In other words, the map was centered so that England was cut out of both sides, even at the expense of Spain, Portugal and a huge section of France itself.

To this day, that memory amuses me. Nationalist hatred leads to some bizarre things.

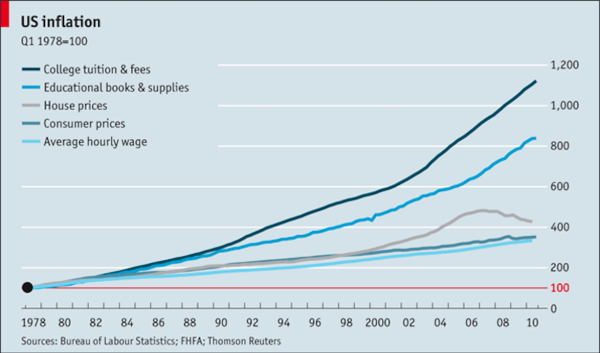

Image credit: Bureau of Labor and Statistics; FHFA; Thomson Reuters, via http://sites.ed.gov/ous/2013/07/weighing-the-cost-and-value-of-a-colleg….

Image credit: Bureau of Labor and Statistics; FHFA; Thomson Reuters, via http://sites.ed.gov/ous/2013/07/weighing-the-cost-and-value-of-a-colleg….

From Ragtag Media on the college tuition & hiring problem: "ETHAN YOUR SCARING ME!!!!!!! YOU Are Espousing “Conservative” Values?…:

“So what’s the solution? Join forces. Form a student-faculty union, and put pressure on the colleges themselves to move away from a model where the administration and the board of directors are the sole decision-makers here. Students and faculty have the most powerful weapons available at their disposal: to put their hands in their pockets and simply do nothing. If you want to change the system, you have to be willing to risk the security of the table scraps you’re receiving. Students: why should you pay so much for a bloated administration and for so little in terms of actual education? Faculty: why should you accept the ever-increasing work burdens for stagnant pay and colleagues who aren’t permanently employed? If we work together, we have everything to gain. We can fix the college/university system. We just need to be willing to work together to cut out the chaff while keeping the wheat.”LOL… Good For You…"

I've always wondered why many people feel that if they're conservative, then everything synonymous with good is also conservative, and everything synonymous with bad is liberal, while if they're liberals, then everything synonymous with good is liberal, and everything synonymous with bad is conservative.

In this case, there are clearly elements of both political ideologies that I support here: unionization with the power to strike if necessary; smaller administration and the removal of unnecessary, bloated bureaucracy; empowerment of workers and service-purchasers; increased individual salaries/economic freedom and the removal of high-overhead services. You're not the only one, Ragtag, to say this, by the way.

Image credit: screenshot from the original Forbes article, via http://www.forbes.com/sites/startswithabang/2016/03/01/why-college-is-s….

Image credit: screenshot from the original Forbes article, via http://www.forbes.com/sites/startswithabang/2016/03/01/why-college-is-s….

I'm actually proud of my Alma Mater, Northwestern, for coming up with a solution (albeit a different one) to make sure that people can afford it without coming out in crushing debt. Tuition there, by the way, at ~$48,000 per year, is approximately three times what it was when I went there, and I was there from 1996-2000. That's a big increase in a short amount of time!

And finally from Dan Milton on why Earth appears blue: "Why do I get and endless loop of Forbes welcome pages?

Please make content accessible somehow."

The Earth actually appeared blue until Forbes started distributing Malware and blocking ad-blockers. Now the Earth appears like this.

We had a good run, everyone. Thanks for stopping by, hope to see some of you in person on Tuesday, and have a great week going forward!

I do understand and support pride in one's Alma Mater, but you do realize that all Northwestern is doing is using under-privileged students as an excuse to raid the school's endowment to cut checks to themselves. Right? In terms of market forces, they're actually making it easier to raise the price of tuition yet further and faster.

While the idea of unionization is nice and all, if you really want to drop the price of tuition, ban student loans. You could even take it a step further and put a seasoning requirement on funds like they do for real estate purchases so as to prove Mom and Dad didn't just mortgage the house to pay for school.

The bubble of tuition cost is being driven, as most bubbles are, by easy access to borrowed money. Student loans are easy to get while being virtually impossible to get out of via bankruptcy, and are being taken out by individuals who feel they have no other choice while at the same time they don't have the experience to fully understand the impact of the debt structure they are building.

Bloated administrations are a symptom. They are bloated because they can be. Until we get serious about the cause of the bubble, we're just rearranging deck chairs on the Titanic.

Beware of accusations, denier. It opens up to others a view into what you would do if you could.

"The bubble of tuition cost is being driven, as most bubbles are, by easy access to borrowed money."

Amazing - in a foolish way.

Dean, Wow,

A ‘bubble’ is created when you distort the value of something’s cost artificially, making that ‘something’ seem much more appealing or valuable than it really is. This can be done by subsidizing a things cost, thereby altering the number of people who will pursue this good or service (driving up demand), or by artificially limiting the supply (like diamonds or oil) which will also drive up demand. When this is done without the blessing of the government for whatever reason, it is derisively known as ‘price fixing’. It never works to the advantage of but a select few in any case.

When you increase the money supply to ‘stimulate’ the economy through low to no interest borrowing, you only encourage more reckless borrowing behavior (great mortgage bubble of ‘08), and a predictable inflation in cost of whatever is being directly subsidized, and eventual unpredictable inflation of cost of un-subsidized things, as well as the erosion of savings and investments as each dollar that holds that value is worth less and less. In addition, you have the added cost of less economic activity from wherever or whomever you are taking the money from (tax payers, investors, businesses, savings). Lastly, you are diluting the value of money when you print huge quantities of it (they bullshit term they now use is called ‘quarterly easing’), just like adding more water to Kool-Aide makes the mixture less concentrated. Money does more than just hold a promise of value in exchange for goods or services, it actually serves as a feedback mechanism as well. When you tamper with the cost of borrowing money, you tamper with the feedback mechanism, and this in turn tampers with the evaluation of price and the spending behaviors of people who are doing the borrowing. This is why centrally controlled economies like the Soviet Union failed, if such polices of price fixing actually worked as some would like to pretend, The United States would have been buried economically long ago. The Chinese are presently learning this lesson the hard way, their entire economy is a contrived bubble which has reached the end of borrowing against their over leveraged real estate assets. Sadly, the United States is not far behind in this.

Risk is a large part of what determines value. Think about it. If you alter the cost of risk, you alter the value of the money borrowed as well. This really isn’t something that can be hand waved away by wishful thinking. As for the moronic thinking of lawmakers (basically, lawyers) that they can set prices for other industries in an intelligent fashion, ask yourself this: If this is such a great idea, Have the lawyers ever been able to consider living under what they would impose on others? Lawyers like Hillary Clinton loved to prattle on about how much a doctor should make, yet fell strangely silent when asked “Why shouldn’t the lawyers also have their incomes set in the same manner as well?” No one proposes something they are unwilling to do to themselves unless it is a bad idea to begin with.

"Dean, Wow,

A ‘bubble’ is created when you distort the value of something’s cost artificially"

CFT, we know. Do you want to try explaining how to breathe too?

And the artificial method here is what? It isn't easy access to money, because money is hard to get at in a recession, and the poverty gap is increasing still.

So what is it?

You see, for a claim to be wrong, it doesn't have to be because the definition of a term is misunderstood, it could be because the accusation given for the term applying is wrong. You need to understand that claims also need explanations or justifications, and that it's not necessarily the case where both are wrong. Sometimes one thing can be wrong.

And in case you're not sure:

And indeed

You can look these meanings up in a

Cft , denier is claiming there is a correlation without presenting any evidence. He is making the freshman level error of saying correlation means causation, and he is automatically assuming the causation goes in the direction he says it does.

That's what makes his comment a load of unsupported twaddle.

Yours is just, we'll, I'm not sure how to describe it.

perhaps?

:-)

@Dean #6

I have no intention on trying to teach you economics if you don't already have at least a loose grasp of it. Banning student loans would necessarily shrink the money supply available to schools. History shows time and time again that when you shrink the money supply it causes a recession by negatively impacting demand.

In this case, a contraction of the money supply available to schools would cause administrators to lose their jobs, educators to lose their jobs, services to be cut, attendance to drop, and tuition prices to fall until a new equilibrium was reached.

Unionization of students and educators will not drop tuition prices. Contraction of the money supply will.

Denier, I doubt you have the ability to teach anything. You clearly don't understand basic statistics (which is what your argument boils down to) for its support. Reducing a comes situation to a relationship between two quantities is foolish. But then, you are the one who did it.

"Banning student loans would necessarily shrink the money supply available to schools."

Proof, please. After all, they can just raise prices.

And please also explain why banning student loans would cause university to become cheaper. After all, they can raise prices and have to to pay their current outgoings.

@Wow #10

No. They can't raise prices. A decrease in the money supply depresses demand. A rise in tuition prices would just serve to further decrease demand.

Here is a paper that goes into greater detail on what I am saying: http://www.nber.org/chapters/c13711.pdf

"A decrease in the money supply depresses demand."

Deano did you just pull that outa your Ass?

You stupid moron, a decrease in money supply HAS ABSOLUTELY NOTHING TO DO WITH DEMAND...

OH!! Money Supply is down So I guess I am not hungry now... LMFAO WTF Financial blogs do you read ya RETARD!!!!!!!!!!!!

Ragtag, try reading again. That comment was by denier, your fellow ignorati.

Geez, Tex, that outburst was a bit 'unchristian' for a wannabe christian, don't you think?

:)

And pj, it was wrong. Look at the name on the post rt attributes to me

Oh, PJ, don't you realise yet that fundie morons like teabaggie here use "Christian" to identify "in groups" and demonise (literally0 "out groups".

Teabaggie and his kind have never followed JC's teachings as stated in the bible. Lip service at best.

Note how teabaggie et al haven't given up all their posessions to live as the lord's disciple, as required. Nor do they give the literal shirt from their backs to the poor and needy, nor love their neighbour like a brother.

It's just a way of labelling themselves as, no matter what they do (see OT), as good, and anyone not agreeing with their dogma, definitively evil.

Nothing more.

Oh, not that the OT commandment against bearing false witness is also thrown under the bus. See Dean's point above.

"@Wow #10

No. They can’t raise prices. "

Yes they can.

You see the graph at the top? Why do you think the line is changing if they can't raise prices????

So a paid for shill "think tank".

There's one for every theology out there. Finding one that "agrees with you" (when in fact it is you agreeing with it, because it is comporting with your personal predilections and bigotries) really isn't anything special. I can find one that claims the opposite.

"You stupid moron, a decrease in money supply HAS ABSOLUTELY NOTHING TO DO WITH DEMAND…"

Then why is it recessions happen?

@Wow #17

They cannot solve a revenue shortfall on a product that is already overpriced by raising prices yet further. If you ban student loans then many won't be able to afford the school and will have to drop out. If the school then raised tuition even further, all that would happen is that even fewer would be able to afford it. The net result would be a decrease in revenue. You are smart enough that I shouldn't have to explain a supply and demand chart.

@Wow #18

You can find a paper that statistically demonstrates that student loans have had no effect on tuition prices? Good luck with that.

"statistically"

You keep using that word and hinting at it but show no understanding of it.

"They cannot solve a revenue shortfall on a product that is already overpriced by raising prices yet further."

Yes they can. They get fewer people but they'll be richer people who can afford it. Same as any luxury good.

And what makes you believe that despite all the other price increases on the same goddamned good, THIS one is the one they can't raise the prices beyond?

The thing I really REALLY don't understand is why the hell you believe this as a matter of unshakeable faith?

" I can find one that claims the opposite.

You can find a paper that statistically"

Yup, because that paper was one crafted by a "think tank" who trots out this sort of crap that panders to the libertarian mindset on a weekly rota.

Just like there are ones that will do the same thing and find statistics to prove the opposite.

Ban student loans? Then you're demanding government tell banks who they can loan money to.

Commie.

"Then why is it recessions happen?"

(Western Economies) Recessions are weird things, sorta like a hang over after a blowout party.

things trend along normally to some degree then you get a boom cycle in a sector or sectors which causes misallocations of resources that chase return further inflating the boom cycle only to come crashing down causing a recession.

"And pj, it was wrong. Look at the name on the post rt attributes to me"

Your correct deano, I inadvertently attributed it to you and I apologize.

I am just so use to you saying stupid things I just started typing away.

@Wow #24

In this case I'm demanding government dictate what funds schools can and cannot accept in order to remain eligible to receive government funds. However as to your accusation on my stance towards lending institutions, I won't deny that I am not libertarian where they are concerned.

"Ban student loans? Then you’re demanding government tell banks who they can loan money to.

Commie."

Denier is not the Commie, YOU ARE. His point (I think) is that by the Govt offering up special laws that guarantee accessibility to student loans and pell grants and others etc..then a market place is created

outside of a normalized credit worthy style free marketplace.

This distorts the market causing people to further distort it by coming up with ways to get the cash that may not be in the best interest of the customer base. I.E Students.

This is sort of a broken window type philosophy. destroy capital paying for "education" that will not be put to good use because it's not really an education that benefits society as a whole.

A degree in Gay and Lesbian Studies is VERY Low To Worthless in the grand scheme of lifting lives out of poverty through education.

Denier just posted while I was typing and said this:

"In this case I’m demanding government dictate what funds schools can and cannot accept in order to remain eligible to receive government funds. However as to your accusation on my stance towards lending institutions, I won’t deny that I am not libertarian where they are concerned."

Denier, I have had similar thoughts. I think IF Govt get's involved then it should only be to pay for basic rigors.

Math, spelling, reading, some basic science and that's it.

Actually, perhaps the best way is to remove the Govt check from paying for any coursework and instead allow the grants to only be used for housing and food or basic living expenses and some basic learning tools, computer ruler paper pencils.

This would ensure a level playing field for the basics but keeping the Govt money out of curricular programs that puts the onus of bill pay on the Student.

". A decrease in the money supply depresses demand. "

Denier, are you sure about this?

You are one of the brightest and most intelligent posters on this blog and one who's input and reasoned post I think are well thought out and responsible.

However, I do not follow the logic of that posted point because the money supply is simply based on credit worthiness of a borrower.

If a person has the credit worthiness to borrow, there is never a shortage of money because in our modern monetary system Money Is Created Ex nihilo.

Again to Dean The Retard, I apologize for attributing the statement to YOU.

Do You Forgive Me?

The fact that I enjoy basing comments on fact and reality results in comments that are completely alien to you, that's all.

Comments like that one contribute evidence to the possibility that you are simply a trouble-causing troll.

I should preface that "Inside Money" is created Ex nihilo

"Understanding Inside Money & Outside Money

In most modern monetary systems money is primarily distributed through the private competitive

banking process. Banks compete for the demand of loans in a market based payment system.

This mechanism to distribute money is essentially a privatization of the money supply to the

private banking system. That is, the primary form of money we all utilize on a daily basis is

controlled almost entirely by private banks (though its growth is largely contingent upon

demand). "

"The fact that I enjoy basing comments on fact and reality results in comments that are completely alien to you, that’s all. "

Follow Up Quote To Beat You With Your Own Cudgel:

"Comments like that one contribute evidence to the possibility that you are simply a trouble-causing troll."

Good Night........... Troll............

"“Ban student loans? Then you’re demanding government tell banks who they can loan money to.

Commie.”

Denier is not the Commie, YOU ARE."

No I am not, YOU ARE!

I'm not trying to tell banks they can't make loans, you're defending someone who is,.

"In this case I’m demanding government dictate"

Who banks can loan to.

"Oh, it's a STUDENT loan" still means a loan, retard.

@Ragtagmedia #30

Yes. Very sure. The term 'money supply' extends beyond just Federal Reserve dollars to include all assets of monetary value.

For instance, say a street has 5 houses worth $200k each. That street is contributing $1 million in real estate value to the pool of wealth. If the real estate bubble bursts and makes those houses worth only $100k, half of the value of those home evaporated into nothing, and the pool of wealth just shrunk by $500k. Any dramatic shrinking of value will depress demand.

The great stock market crash of 1929 led to the Great Depression. The devaluation of the US dollar in the 70's caused the Malaise/Stagflation that Ronald Reagan is credited with saving us from. More recently, the bursting of the tech bubble in 2008 led to the recession blamed on Dubya, and the bursting of the housing bubble led to Obama's so called "Great Recession".

When aggregate wealth is decreased, people feel less secure about making non-essential purchases or they simply can't afford to buy as much. That shows as a downturn in the economy.

Don't confuse demand with desirability. Demand has a price component. You may desire to eat an apple, but if the price of apple shoots up to $50 each, you might be inclined to eat at Taco Bell instead. It isn't because you or anyone else likes apples any less, but the price of apples being set at ridiculous prices will reduce the demand for apples.

The thing to remember is there's not necessarily demand where you think it is.

Nobody demands to go to university just so they can rack up a loan. Just doesn't happen. So the demand for loans is for going to university for a reason.

And very few people out of those to want to go to university do so because they just really REALLY want to go to university. Most go because employers demand a degree.Don't get a degree, fit yourself up for a job flipping burgers. Want to get ahead and get an interesting fulfilling job? Gotta get a degree. Even if the job doesn't need one, if you don't (and aren't getting in on nepotism), you'll lose out to someone with a degree.

So most of the demand for university is caused by employers wanting degrees, even where not needed. Indeed most of the degree inflation is due to that.

Loan out 100k at 18, get a job earning 30k with prospects to go to 100k. Don't loan, get a job earning 15k with prospects to keep it 15k in the face of wage deflation.

That housing bubble burst before Obama took office.

Kind of odd to blame him for something before he got in charge...

I think you'll find Shrub is at fault for that one (with some help from the Republicans, of course, but also the Clintons at the time).

Wow. The things you repeat that have no basis in reality are astounding. Next you'll repeat the old myth that his policies led to the breakup of the Soviet Union.

@Wow #38

I don't blame Obama for the housing bubble. I also don't blame Dubya.

If you must lay blame for the housing bubble at the feet of someone in the government, it would be Representative Barney Frank (Chairman of the Financial Services Committee) and Senator Christopher Dodd (Head of the Senate Banking Committee). The 2 men most in charge of oversight were both bought off by the Wall Street banks and actively ran interference against any effort to rein the banks in. It is almost criminal that the two were allowed to pass the Dodd-Frank Wall Street Reform and Consumer Protection Act afterwards in an effort to hide their complicity in creating the very mess the later act was supposed to fix. Both should have ended up in jail along with several dozen bankers.

"I don’t blame Obama for the housing bubble. I also don’t blame Dubya."

cf

"the bursting of the housing bubble led to Obama’s so called “Great Recession”."

If you don't mean to blame Obama, you need to sue your keyboard for defamation...

PS wasn't it Frank Dodd, not Christoper?

@dean #39

Never said I believed it. Only said he was credited with it. Most of the credit goes to Paul Volcker. I do think Reagan was truly great president, but not for that reason.

I do think some of his policies put pressure on the Soviet Union, but the straw that broke the camels back was Baywatch. Communism can't compete with Pam Anderson in a tight red swimsuit. People saw that and had to have it. Baywatch was a minor show in the US, but was a world wide phenomenon and walls came down everywhere it aired. I'm not sure if the pen is mightier than the sword, but there is no denying the power of boobs.

@Wow #41

Nope. Barney Frank and Christopher Dodd are two different people that get lumped together (and should be sharing a jail cell).

"Yes. Very sure. The term ‘money supply’ extends beyond just Federal Reserve dollars to include all assets of monetary value."

Denier, with all due respect, I think you may be getting some misleading information with regards to how the modern monetary system actually functions.

In fairness, 98% of economist don't even understand.

Here, if you really wan't to understand how our modern monetary system actually functions, read this:

http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1905625

That there is the single best FREE information available online that online that clarifies how the system functions hands down.

This is basic dual account book entries.

A credit worthy customer goes to the bank and request a loan. The bank agrees he is credit worthy and thus creates a loan Ex nihilo or Out Of Thin Air. And now there is a double account book entry.

A debt on the banks side and a credit in the form of a deposit on the customers balance sheet.

The bank is hoping to make a profit in the interest rate spread as the loan is paid back.

Remember WE ARE NIT on a Gold standard anymore which is a good thing.

It's amazing how WOW can find. Reason to whine and butch on literally EVERY article. I bet he does this on yahoo and various other sites as well. "Physics makes me angry. Let me pick fights with people online...every night!!" What a complete fucking loser.

Oh loo, bri is whining.

Again.

"Nope. Barney Frank and Christopher Dodd"

Ah, fair enough.

I guess I can see how I heard Frank Dodd when it was Frank/Dodd. Or would have been if it were written down.