Though of course by "natural" we're thinking of with-a-human-contribution. My text is taken from the book of Grauniad:

On Friday a team of researchers in Boston calculated that even with only a 2C rise, summer temperatures now regarded as "extreme" will become normal. This is the second such warning from the US this summer. Europeans in 2003 and Russians in 2010 had lethal experience of heat waves. ... Munich Re predicted that 2011 - on the evidence of the first six months alone - will be the costliest year ever for disasters triggered by natural hazard. Total global losses by June had reached $265bn, far outstripping the $220bn record set for the whole of 2005.

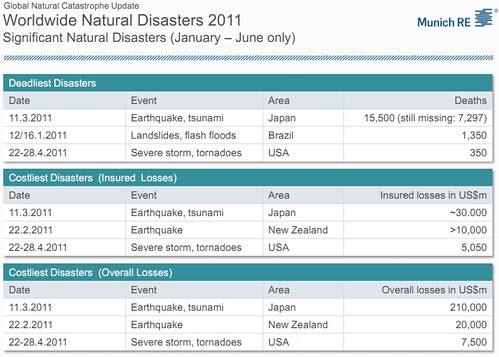

But without directly taking a position on the vexed issue of how natural disasters have increased due to GW, it is clear that the Grauniad is talking bollocks. Or rather, it is clear that while what they say is literally true, it is deeply misleading. Consider this slide from the Munich Re report:

So, that is at least $40 billion in unexpected-earthquake (insured) losses, or $230 billion in overall losses. And if you compare that with page 29 on the same report, you see that 2005 was ~$250B (not sure why the Grauniad says $220B, perhaps different to-date adjustment). So the "not including earthquake" losses for 2011 are "only" ~$40B. Note that the Indonesian tsunami was 2004, but December 26th, so might have bled into 2005; but anyway according to p37 wasn't very expensive - presumably because of where it occurred. Katrina was the big cost in 2005. The Spring 2011 tornado season in the US looks to have been costly, in comparison to other tornado seasons.

Incidentally, if you scroll down further you get various financial bits, which I don't understand. p58 shows that underwriting capacity is at an all time high, which is presumably good.

h/t Timmy.

Refs

- Log in to post comments

"underwriting capacity is at an all time high, which is presumably good."

Depends who you are really. If you want to buy insurance it's just great. More capacity means cheaper prices for the buyers. If you're the insurance company, not so good. It means you've got lots of capital available to write insurance against. So you're not earning much money on that.

But the real thing to remember about insurance companies is that they don't really make money on writing insurance. In a competitive market in fact (say, auto insurance, life) they almost always make a small loss on the actual insurance business. However, they get the money right now in premiums and only pay it out some time in hte future. So they invest the money and that's where the real profits come from: having billions of other peoples' money to play with for a time.

[That sounds plausible, and indeed perhaps inevitable. If there is money to be made from the investment side, that should inevitably drive premiums down below cost -W]

A major part of the cost of disasters is not captured in the cost of destruction, but rather is the cost of adaptation, for example, hardening buildings against earthquakes, hurricane straps, etc. Some of this is driven by zoning and safety codes, other parts by the insurance companies demanding that structures be secured, other (floodways and dikes) by public expenditure. Since this is not captured in the data, nor by any of the people claiming to be experts in this area, it is hard to tell what is really the cost.

This has been a tough year for the Munich Re group because of the large number of serious earthquakes, but credit them at least for trying

and also, insurance (other than life assurance) is one business where the company can earn revenue at zero cost - eg taking premiums from people who never claim. As Tim says, investment gains are important but even more important is making sure that you pay out on as few claims as you can. If capacity is high, you end up having to reduce premiums to attract new policy-holders, or maybe relaxing criteria...which can lead to problems down the track

Without wishing to come across as too credulous a yokel and somewhat tangential, is it possible that the loss of Gt's of ice from the poles reduces the stability of tectonic plates exacerbating tendencies for earthquakes? Several abstracts such as this one seem to support the hypothesis.

Or is it the case that Gt's may be a big number in human terms but mere featherweight to the Earth's crust and I may be overdue an appointment at the aluminium milliners?

[The ice-age ice certainly depresses the crust; we're still rebounding. Local to the UK, Scotland is going up and the East of England is going down (which accounts for most of the "sea level rise" observed in the E of England, I believe). So I think I'd believe your abstract about small earthquakes in related regions -W]

I probably was too cryptic...in a time of high underwriting capacity, the insurance industry needs possible buyers of catastrophe/rare event insurance to buy....so be guarded in anything you say about linking extreme events to warming. If the risks are "real", then report them, otherwise it is the insurance industry doing what it does best, making money out of the way that most people/corporations cannot quantify risk.

chek | September 12, 2011 4:04 PM --- Mass redistribution is thought to promote the frequency of small, shallow earthquakes.

http://earthquake.usgs.gov/earthquakes/recenteqsww/

William, help me out, I'm missing something. The title of this article 'Natural disasters (again)' under the category 'Climate Communication' with the statement:..by "natural" we're thinking of with-a-human-contribution.', seems to imply that earthquakes somehow have a human-contribution related to greenhouse gas emissions. Do you believe greenhouse gas emissions have an influence on plate tectonic activity?

[No, except in the minor sense explained in the previous comments. You need to read the Guardian quote -W]

The recent earthquakes in Haiti, Chile, and Japan) occurred at depths of 10 km, 32 km, and 35 km, respectively. Temperatures at these depths are between 250 and 875 degrees Celsius (450 and 1575 degrees Fahrenheit) and pressures are between 2500 and 8750 atmospheres. If some human-contribution related to greenhouse gas emissions is in part responsible for any of these earthquakes, please explain the mechanism. Thanks.

Veli Albert Kallio, FRGS, geophysicist, leading ice expert, and Plenipotentiary Scientific Ambassador for the Global Environmental Parliament Group, believes that the frequency of major suboceanic earthquakes is increasing because the extra mass from polar meltwater 'massages the elastic properties of the oceanic plates like [a] baker's roll[ing pin] moves over his dough. Over huge oceanic distances this spread effect becomes significant.'

I assume that this is nonsense (or so tiny an effect as to be irrelevant), but what about tides and wind-driven water? The height of the oceans increases far more because of them than it does because of trickling meltwater - and does so in a far more rolling pin-like manner. Do they have any effect on seismic activity?

[It all reads like utter bollocks. As said in the previous comments, there is a small physically reasonable effect; but nothing that would cause major quakes -W]

More on Kallio's theory HERE.

[Aie: The local Inuit population, whose lives have been drastically altered by the changing climate, were yesterday led in a silent prayer for the future of the planet by the Ecumenical Patriarch Bartholomew, the organiser of the arctic symposium and spiritual leader of the world's 250 million Orthodox Christians. The Inuit are not being drastically altered by GW, but by contact with the West. Otherwise they would know nothing of Orthodox Christianity -W]

Well, maybe a bit of both?

Earthquake occurrence data (from USGS) does not demonstrate the statistical property of stationarity. I'd be very leary of being a counter-party, i.e., underwriter, to/for anybody's earthquake insurance.

Depends on how you define West. That sound quite Siberian to Eli

Thanks for the response to comment #4 William. I fell into the layman's/ignoramus trap of thinking a crust is a crust is a crust and such over-generalisations, before realising further reading is required.

These scienceblogs are good, aren't they?

Mr Benson

Think of the insurance industry as bookies. They will make odds to attract money. Money-in is good. Money-out is bad. So if the "science" says the area your house stands on will subside in 12 months....how much would you pay to insure against that ( so that you can buy another house)? That is the rationale of insurance. And if you buy insurance for any other reason, please study some economics. Insurance companies do their best not to pay out on claims. That is their function, despite what they say.

I wish people would make their minds up about Munich Re. The 'Re' stands for reinsurance, in which case they get accused of making money by scaring primary insurers and push up policy prices. On the other hand they also act as primary insurers (ERGO Group), in which case they must be making money by scaring and trying not to pay out on claims to themselves. But on a third hand, they may have to ensure that their data is the best possible so that they can objectively evaluate risks in a manner that means make-believe can't land them a fatal bite on the arse, and that their commercial decisions are sound as a pound.

J Bowers | September 14, 2011 7:59 PM --- Munich Re has a large and capable group of actuaries to keep the data and do the risk estimations.

All-in-all, Munich Re and Swiss Re (are there others?) seem to be performing a needed service.

J Bowers - maybe you should spend a day at a racetrack as a book-maker. It is a very fine balance between attrqcting bets at crazy odds and risking a damaging payout if all goes wrong. Just try to do it for yourself and then you will understand what the insurance companies do...and the reinsurance companies. The odds are stacked against the punter. The degree to which they are stacked depends on "permissible" profit margins, and also what the competition is doing. On the track, you will be surrounded by people dancing around your odds.Try it...it is fun if hair-raising if you are the guy trying to keep track of what you are risking on each race. Maybe a Stoat day out where he lays the odds?