Bored with force X from outer space? Was Force F just too fuckwitted, and part 22 just too dull? Then why not play "hedge funds"? Hedge funds do lots of complex maths and make lots of money (only not so much recently); they also have the advantage of being opaque. So play today, with Jo Nova and her band of performing marsupials. Yes, I know, its a picture of a monkey with an arrow up it's bum, and a monkey is not a marsupial. But no known mediaeval manuscripts feature marsupials.

Bored with force X from outer space? Was Force F just too fuckwitted, and part 22 just too dull? Then why not play "hedge funds"? Hedge funds do lots of complex maths and make lots of money (only not so much recently); they also have the advantage of being opaque. So play today, with Jo Nova and her band of performing marsupials. Yes, I know, its a picture of a monkey with an arrow up it's bum, and a monkey is not a marsupial. But no known mediaeval manuscripts feature marsupials.

Context, context: I forget the context in my obsession with primate posteriors. coolfuturesfundsmanagement is, like, a hedge fund. Run by Jo Nova! And some others. Or perhaps better, a wannabe hedge fund with a severe shortage of moolah. And its going to hedge against cooling, maan. Tagline: "Are we preparing for catastrophic warming when we should be preparing for cooling?"

[Update: via RS's "Zombies of the Stratosphere" I found a great B-movie review site; you should read their review of Absolute Zero, not my maunderings.]

Who were those masked men?

Suppose you had some spare money to invest and wanted to turn it over to a hedge fund. You'd want to see some kind of track record, no? If the fund was new, as this one is, you'd want to see some kind of heavyweight with relevant experience. Does CFFM have such? There's an about, so we can find out. Their people are:

* David Evans, chief pusher of force X. Um. He can do fourier analysis with a following wind.

* Jo Nova, assistant chief pusher of force X. She can do... PR?

* Stephen Farish. Who? "He built the SES model used to determine funding schemas in Australian Government health and education programs". He appears to be an assistant prof at the Uni of Melbourne, and associated in some way with Michigan, but I couldn't find any papers post-2013. Not an obvious member for the board of a hedge fund.

* Chris Dawson "is an entrepreneur and manager" - ooh, exciting, tell me more - "having founded and run numerous innovative enterprises" - oh. Could you be more specific? "His current roles include CEO of the Lord Monckton Foundation". Oh. Oh dear. CD, and SF, are remarkably google-light; as though they weren't heavyweights.

* Andrew Vallner "is an external consultant to the fund. He is an experienced asset consultant". He does appear to exist, currently running CPG a small-looking investment advice group. Looks like the only one with any kind of investment credibility, and that is thin. Curiously the bio mentions CUNA but not CPG; and I find no news of his time at CUNA. There's a (self)bio here.

And don't get me started on all their website photos being freebies, the cheapskates.

Enough ad-hom. What's the plan?

If we pretend to take this seriously as an investment plan, we can do what no sane investor would do and disregard the credentials of the people running this thing, and instead look at their plan for Making Money, which is what hedge funding is all about.

They have a three-step spiel: one: DE has brilliantly shown that current climate science is all wrong; two: solar theory is right, and strongly suggests cooling; and three: As we approach this period of global cooling, and the leading indicators are evident, we will better refine the timing, magnitude and investment strategy. Ah: could you explain again how you're going to make money out of that? Citizens of the West are watching the miscalculation of value and massive misallocations of their pension funds and long term prosperity. Our plan is to stop this mindless waste. Very nice, do go on: With a self funded, highly profitable due diligence process and cost benefit analysis on the science, economics and finance of climate change, we will literally hedge our bets on climate change and on changing climate change policy. Still a touch opaque, no? Fortunately, they ask themselves a Penetrating Question: What and how should we invest, if we know that carbon dioxide is 'innocent' of being the main cause of catastrophic global warming*; and that the timing (soon), magnitude (significant) and sign (cooling) of the next major climate shift will have an impact on many markets and economies? But: do they answer it?

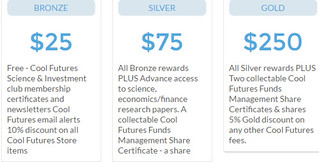

Under "what can you do?" they have two options. "Larger sophisticated investors" can, effectively, talk to CFFM, how nice for them. For the plebs, there's crowd funding mechanism. This has a nice "donate" button, which would appear to be an odd way to "invest" your money; but $250 buys you errm, a gold badge and some "collectable" share certificates, somewhat like cigarette cards I suppose. Oh oh hold on: from the "plan": The hanging of your Cool Futures Funds Management share certificate on your wall will be a small but empowering action you can take representing the start of something big and something ultimately positive and beneficial and scientific. Oh come on, can anyone but the Faithful possibly fall for that?

Under "what can you do?" they have two options. "Larger sophisticated investors" can, effectively, talk to CFFM, how nice for them. For the plebs, there's crowd funding mechanism. This has a nice "donate" button, which would appear to be an odd way to "invest" your money; but $250 buys you errm, a gold badge and some "collectable" share certificates, somewhat like cigarette cards I suppose. Oh oh hold on: from the "plan": The hanging of your Cool Futures Funds Management share certificate on your wall will be a small but empowering action you can take representing the start of something big and something ultimately positive and beneficial and scientific. Oh come on, can anyone but the Faithful possibly fall for that?

So, I should be reading The Plan. Kewl. Let's go:

We believe the Cool Futures Hedge Fund will publicly, economically, politically, scientifically and financially challenge and - on so many levels destroy - the catastrophic anthropogenic [man-made] global warming (CAGW) paradigm and draw attention to all the weaknesses in the myth that 'human emissions of carbon dioxide is the dominant cause of dangerous, unprecedented, runaway, unstoppable global warming'. Our aim is to create a self funding high profile vehicle designed to inform the world of carbon dioxide's innocence, extract significant value from the collapse of the CAGW paradigm and to help prepare the world properly (with prosperity) for natural climate change, whether in the form of global warming or cooling.

That reads to me like someone has forgotten they're supposed to be a hedge fund, not a pol or a blog. Then we move over the Yet More Plan (this has weird echoes of force X, where one page would tantalisingly almost reveal the answer, only to push you onto the next page, repeat ad nauseam). One part of the Yet More Plan has already failed:

A number of alternate strategies will be further refined and revised to ensure the red team media take the bait and attack Cool Futures, providing it with global media exposure in the lead up to Paris.

They weren't attacked, they were ignored. But - oh noes! - Now I've fallen for their cunning plan and attacked them. Damn, they'ye clever than I though.

Jo Nova now has a blog post pushing this stuff - so I suppose I'm in a race with Sou, has she got there yet? No, good - in which even more plan is revealed, by CD no less:

Like in the movie the Big Short (which was based on a true story...

Yes, that's right, the plan is to work by analogy with movies. How could that possibly fail? To be fair, as in the end I suppose I have to be, they do say

The vast sums of money diverted and misallocated to reducing carbon dioxide emissions by solar panels, wind farms, electric cars, ‘carbon trading’ and so on, will inevitably lead to a collapse of these schemes through sheer economic waste. This collapse will produce numerous opportunities for profit.

And that's not entirely ridiculous. There are indeed vast misallocations of money in subsidies (because we don't have a Carbon Tax). However, the existing market knows this; it isn't clear CFFM has any special advantage. I'll spare you phase 2, because it is vacuous, but phase 3 isn't much better:

As it becomes obvious we are entering a period of natural global cooling, we will have timed the taking of various profitable positions for maximum return, especially in agricultural and energy commodities. The current low price regime that has emerged provides fertile ground for good value selection of long positions.

This is a long-term strategy and is, again, competing against all the other players with no special advantage. They don't have a hope.

Are these people serious?

Who knows? I did run across I’m putting my money where my mouth is and betting against climate change - "I’ve invested in a fund that will aim to short-sell overvalued renewable energy stocks" by... wait for it... James Delingpole! As you'd expect from Dellers, it's a disappointment: he's spent1 $75 on a bronze badge. Which means he doesn't believe in it.

FWIW, these people have a Fb page. You should go troll them: I did.

Notes

1. Sou points out that the list of donors doesn't obviously include D, so it is entirely possible that he is lying about the $75; it would be unsurprising.

Refs

* THE NORTHERN ROCK OF THE CAYMAN ISLANDS ICECAP: HE HAS A CUNNING PLAN.

* dailykos

* Update from HotWhopper 2017/02: it isn't looking any better.

* The Most-Hated Bear in Solar Isn’t Backing Down by Brian Eckhouse, February 16, 2017.

What part of "grifters gotta grift" were you unclear about :)

Let us not overlook the contribution to investor education of Bishop Hill and his jester Josh , who have branched out into children's books:

http://vvattsupwiththat.blogspot.com/2016/06/turboriddler-rightway-toll…

Well, perhaps they've been reading The Long Con, and want to get in on it (from the money-making end)...

That is an ape not a monkey.

https://nationalzoo.si.edu/Animals/Primates/Facts/

Don't be an Aye-aye, Gee Aye.

It is a known fact that the monkeys have no tails in Zamboanga.

Re: Chris Dawson

I offer examples at the Lord Monckton Foundation CD runs,

from links in this analysis of 2013 SalbyStorm

Professor Murry Salby at Macquarie University. From Science to Dismissal, in his own words

and STATEMENT REGARDING THE TERMINATION OF PROFESSOR MURRY SALBY.

and there were:

The Journal of Pattern Recognition in Physics Affair"

and

It’s official: no global warming for 18 years 1 month (October 2014), by the Viscount.

Perhaps these will give more confidence in CD's role in this new venture ... or perhaps not.

"We don’t know the mechanisms behind forces X, N, or D. In this post we canvas a few of the possibilities, but offer no opinion on which if any it might be."

Such a definitive statement from Sergeant Hans 'DE' Schultz.

DE: Yes, there just isn’t enough data. It might take centuries to collect enough data on how the Sun affects the Earth to be reasonably sure — there have only been 3 or 4 solar cycles since satellite observations of the Earth, and, for example, it is far from clear that TSI and all its components are measured well enough even now.

DE: For the last 100 years solar has predicted warming and CO2 has also increased, so we couldn’t really figure whether it was solar or CO2 causing the warming. But in the next decade, solar predicts colder and CO2 predicts warmer. We shall see.

DE: Correcting the architecture in the model and feeding in the data gives a highly probable range for the ECS of 0.0 to 0.5 deg C.

DE has the RHS of the equation figured out based on the LHS being equal to RAND()/2.

DE: I hear nothing, I see nothing, I know nothing!

Great tip re millionmonkeytheater. Point of reference: FZ, "Cheepnis."

[Not available over here; I suspect https://www.youtube.com/watch?v=gzxa49fefq8 -W]

As for the finance stuff, well, I believe I'll stick with Fidelity for now. Perhaps someday I'll regret not taking up the Cool Futures Fund.

The primate with the arrow up its bum is mostly likely a Babary Macaque - not an ape, and as excluding apes makes "monkey" paraphyletic, pedantry here is a bit tedious.

The marsupial-centric of us mark the end of the Midle Ages by the arrival of the first (modern) marsupial in Europe in 1500.

andrewt I take my hat off to you and your ability to make the Barbary call.

On the subject of "monkey" and paraphyly, I have to agree but also argue that it is justified that I made the distinction. Monkey is paraphyletic as a common name and not as a taxonomic grouping; even if Apes share a mrca with monkey taxa that are more distantly related to other monkey taxa, I contend that the depicted tailless primate of that form and with those buns is better called an ape and not a monkey (in the loose and unscientific way that I am using these terms).

Having said that I am happy to call birds dinosaurs even if, and possibly because, it annoys people.

It is entirely prudent to make investments as a hedge against cooling temperatures. For example, I recently purchased two very nice wool sweaters at a summer clearance sale.

Ok.. so if we could just find out what investment positions these guys are taking, perhaps we can start up our own hedge fund to take the opposite positions.. Profit!

Reminds me of The Long Con.

Is this the most elaborate spoof/parody. Good on them for wasting so much time on it.

I reckon they're calling the bluff of all the crazy deniers out there - come on Nigel Lawson, Donald Trump, Koch Brothers....put your money where your mouths are.

Well, they've got a well-established audience of gullible marks, so I suppose it only makes sense to try and shake them down...

The whole hedge funds being rubbish compared to stocks thing is a huge case of massive false benchmarking. The S&P 500 is basically the 500 most valuable companies in the US (and hence nearly the world), so it's nowhere near representative of either the stock market or financial markets in general. The fact that buffet got some fund managers to agree to a bet with hedge funds benchmarked against the S&P500 says more about the egos of people who work in hedge funds than anything.

[Maybe. Would you care to point to a different comparison? -W]

The 2&20 fee structure is insane too, mind, and will have to disappear.

Just having a browse around in search of anything that might bear any kind of resemblance to anything you would normally expect to associate with a hedge fund (you know, crazy, esoteric stuff like, oh, an offer document) and I notice that their "Disclaimer" page is branded with the Mark of the Crank:

Googling the specific text, I see that they've lifted their entire disclaimer word-for-word from the "Legal" page of Cayman National (https://www.caymannational.com/legal/index.html), simply replacing the words "Cayman National" with "Cool Futures Funds Management". I wonder if they have the requisite "prior written consent" for that?

Hmm, not sure what Dellers is on about, but the mention of long-term bets on agricultural and energy commodities makes me think all they're really doing is getting in on what chart eyeballing suggests *might* be a market bottom. But as you say, this is entirely common knowledge.

Actual shorting of renewable energy stocks is a different matter, and while such an approach is plausible re solar given the inherent volatility of that sector I suspect some serious expertise (entirely lacking AFAICT) in it would be needed to have much hope of success.

Speaking of long term, I suppose that if their investors can't pull their money out before X amount of time has passed, then even if commodities go south on them DE and company will still be able to make a nice living off management fees even as the fund value tanks.

12

As the original post notes,

http://vvattsupwiththat.blogspot.com/2016/06/the-northern-rock-of-cayma…

a fiduciary alternative to the Cool Futures Cayman Islands play is already available :

MORE SOPHISTICATED INVESTORS MAY SEND FUNDS DIRECTLY TO

MNESTHEUS@PAYPAL

SECURE IN THE KNOWLEDGE THAT ANY MONEY LEFT OVER FROM PROSPECTING FOR ICE MINES ON PETIT MUSTIQUE WILL BE SPENT ON R&R ELSEWHERE IN THE SPANISH MAIN

"

Hilarious. Just hilarious. I hope not too many idiots get bilked.

Is that it? If I'm sending my money to loons I want more than some ranting and a letter from the Flat Earth Society.

Cleverer is the word you were looking for.

When a warming scam gets big enough I will try to buy some options and short it at the top.

Not while it is getting the top ups at the start.

Mind you on my brief foray into options I was burnt.

Consider Nigerian "419" scammers.

Websites marvel at the idiocy of the proposals ... but actually, it has been pointed out that these are brilliant and efficient

they rapidly weed out real skeptics in favor of the most gullible.

See also scam baiting.

I am tempted to tender a crisp $10,000,000,000,000 Bank of Zimbawe billl to Cool Futures, in return for a controlling interest in the fund, as my contribution would hedge them against the contingency of hell freezing over before their strategem pays off.

lol.

Really? You surprise me. You seem like a very sophisticated investor.

Russell, you are an education:

New Hyperinflation Index (HHIZ) Puts Zimbabwe Inflation at 89.7 Sextillion Percent

http://www.cato.org/zimbabwe

Cool to put sextillion in a sentence!

For more on the long tradition of right-wing politics as a grift, see The Long Con, http://thebaffler.com/salvos/the-long-con .

A sextillion is what many hope a debutante ball will become when the chaperones go home.

I acquired my 10 million million dollar bill as one component of an as yet unrealized global albedo modification experiment:

http://vvattsupwiththat.blogspot.com/2013/10/hyperinflation-look-on-bri…

Now all I need is someone with change for

$10,000,000,000,000

@ # 24

Microsoft have written a research paper on this topic

"why do scammers say they are from Nigeria"

http://research.microsoft.com/pubs/167719/WhyFromNigeria.pdf

#31 thanks!

19th June $41630

28th June $44155

$2525 in last 9 days, last donation 5 days ago.

Are the fees off $50,000 worth the cost and effort of complying with all the regulations to avoid getting into trouble for failing to do something?