oil shocks

Kurt Cobb as usual gets right to the practical heart of the matter in his latest column about why expanding claims about reserves, EVEN IF TRUE don't translate to cheap oil and gas:

Here's the short version of why forecasts of low long-term oil and natural gas prices are almost certainly wrong: It costs more than that to get the stuff out of the ground. Only two things could actually lead to low long-term prices: 1) Somebody could invent and deploy some genuinely brand new technology that makes it really cheap once again to get oil and gas out of the ground or 2) we could have a deep and…

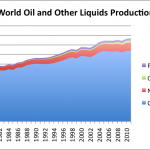

The EIA, unlike the IEA, has been strident in its dismissal of peak oil. But the data that the EIA publishes tells a very different story than the one it wants us to hear. Gail the Actuary has a really good analysis up at the Oil Drum.. The essential message - that crude oil production remains basically flat, as it has since 2005, and that growth in non-crude "liquids" (all those things that have made up for the lack of crude growth in world demand) aren't growing as fast as desired or predicted.

Among the critical takeways - that unconventional oil production probably will cease to keep…

From the UN FAO, we can see that world food prices remain extremely high. We also, I think, when we conjoin this with oil prices can see that there is at least a significant correlation.

So much of what has been done in agriculture over the last 75 years has served to tie oil and food prices more tightly together, but it is increasingly clear that the world's poor cannot afford to have their access to food controlled by the price of energy on world markets. That kills people, to put it as bluntly as possible.

This is one of the reasons I'm least convinced that improving agricultural…

Every time oil prices get high, the SPR becomes a central issue. I really like Kopits' analysis here - I think he may be right that the impact of the SPR might hold off an oil shock. At the same time, the question is whether we would then be able to build it up again, and whether we face greater subsequent shocks.

The SPR holds 727 million barrels of crude oil, about 40 days of US consumption and 70 days of oil imports. In addition, the US has about 1.1 billion barrels of commercial crude oil inventories. All in all, the US has sufficient domestic crude oil stocks to cover about six months…

The phrase "oil shock" is being thrown around a lot in the national news, and events in Tripoli at the moment seem to be reinforcing the idea that we're facing an extended period of instability, and possibly a new cycle of oil price increases and the stress on personal and public economies that accompany rising prices.

Is this a given? No, but there are similarities here to prior experience. The most important point is that while everyone notes that Libyan oil is less than 2% of world consumption, that supply constraints don't have to be significant, or even present in order to cause a…

Two good recent articles on the implications for oil prices and production of the situation in Libya. First, Tom Whipple's always cogent overall analysis:

While the 1.6 million barrels a day (b/d) that the Libyans pumped in January may not appear significant in a world that produces some 88 million barrels each day, we should remember that those barrels are being consumed somewhere in a world where they are consumed just as fast as they are produced. If there is anything that we have learned in the last 40 years, it is that relatively small disruptions in oil production can lead to…