When I discovered that Shakes, filling in over at Crooks and Liars, had linked to my post about Senator Obama and Social Security, I thought might get hordes of angry Obamaites*. Instead, what some of the comments repeated two common mistakes about Social Security (although thankfully other readers slapped them down).

The first fallacy is that Social Security is in crisis. It's not. Let's try this way of explaining it, since the other ways don't seem to have worked (an aside: why do I even put hyperlinks in my posts? The conservatives either don't bother to read them, or don't know how to click on them). If in 2000, the Social Security Trustees announce that Social Security will be insolvent in 34 years, you would expect that the 2001 report should state that Social Security will be insolvent in 33 years. The 2002 report should claim that the program will be insolvent in 32 years, the 2003 report would claim insolvency in 31 years, and so on. Straightforward, yes?

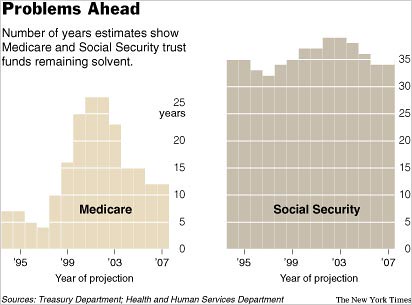

Well, suppose the Trustees told you every year for fourteen years that Social Security would go bust in thirty four years, give or take (this is known as a Samuelson Unit). A member of the Coalition of the Sane might conclude that the Trustees are a wee bit, erm, pessimistic. And lookie, a picture (the bar graph on the right):

To not get this, you not only have to have funnel-chugged the Konservative Kool-Aid, but also undergone full-immersion baptism in it. As the post title states, the reality of Social Security has a liberal bias--it's not a "progressive" plot (an aside: I'm a liberal, not a 'progressive'). But enough of fucking morons who can't read bar graphs. Let's move onto a substantive, albeit flawed argument.

I noted in an another post (and virtually every other time I've ever discussed Social Security):

3) Social Security generates a large annual surplus (about 25% of revenues). That surplus doesn't wind up under a mattress out at Area 51, but is used to purchase government securities, which, if need be, can be liquidated to pay out benefits (see point 4). Essentially, the government loans itself the surplus. Alternatively, think of the annual Social Security surplus as the world's largest municipal bond issue... held by you. The real crisis is not the solvency of the program, but the drop in excess revenue that will most likely occur. That would affect the general (national) debt (and budget deficit obviously).

4) In the bad case scenarios, Social Security will no longer generate enough surplus revenue, and would probably have to dip into the Social Security surplus to pay out benefit. This would represent the U.S. liquidating the debt that it holds...in itself, raising the official U.S. debt (if you hold your own debt, it doesn't really count as debt).

Now, a lot of well-meaning people will read that and conclude that we should either cut Social Security benefits or raise the cap on taxable income in order to solve the budget crisis. Personally, I think eliminating the cap on taxable income would be a good thing--if you're going to have a regressive flat tax, at least tax all income with it. But that policy change is not required to prevent a non-existent Social Security 'crisis' (see the above pretty picture). There are plenty of other policy changes--budget cuts in other programs and other tax increases--that can be used to reduce the budget deficit. For instance, not invading the wrong fucking country might be a good start. Just a thought.

This is the critical point: to address a general budget crisis, a program that has lifted millions of elderly, orphans, widows, and disabled out of poverty should not be weakened. To this fourth generation Democrat, that is a core value of the Democratic Party, not to mention the prophets Amos, Isaiah, and Jeremiah.

If Democrats don't stand for our signature program--a program that has defined Democrats for the better, then what's the point of having Democrats at all?

*Doesn't one version of the Ten Commandments say that you shall not make a covenant with an Obamaite? Or maybe it's a Jebusite?

Of course you are right. The "SS is in crisis" line is just another in a fairly long string of attempts to destroy government in general and SS in particular. SS is in crisis, and the only way to save it is to destroy it. Government is the problem, so let's make it so damned incompetent that the only solution is to destroy it. Except where it benefits the extremely wealthy. See copyright law, for example. See the military-industrial complex (a rather nice Republican coinage I think) for another example.

I personally know two people who would be destitute without social security. It's a mighty small safety net, but it's all they have.

I don't like the "crisis" frame either, but the numbers aren't quite as unfounded and variable as you make them out to be. In 1990, the predicted date that the fund would be exhausted was 2043. In the early 90s, the projection was revised closer (presumably due to economic conditions causing the fund not to grow as fast as expected), bottoming out at 2029 for a few years. As economic conditions improved, the date was pushed back, peaking at 2042. For the past 6 years, that prediction has been pretty steady, fluctuating only between 2040 and 2042, with no general trend. Obviously, the number isn't a hard and fast date, but it also isn't always 34 years away.

Even drawing down the trust fund many years from now need not require cash outlay from the general fund. If we maintain US Treasuries as the safest investment in the world we can roll Trust Fund bonds into regular Treasuries. No net change in public debt, perhaps some change in interest. Of course we could cut of this possibility if we destroy our credit rating in Middle Eastern sands.

Kelly, I don't think you get the concept.

"Even drawing down the trust fund many years from now need not require cash outlay from the general fund."

The point is that people want CASH deposited in their accounts, not IOUs. So the IOUs in the trust fund need to be CASHED. The SS people walk over to the Treasury people and say here is your IOU, give the $100 million. Now, at this point, the regular budget does not have ANY excess cash from FICA payments, and most likely is spending more than it brings in in taxes anyway, so the good people at the Treasury just say SURE and DIGITALLY PRINT UP $100 million bucks and the next time the open market committee does a refinancing they just add $100 mill to the amount that the government needs to borrow.

"If we maintain US Treasuries as the safest investment in the world" - this does not really matter, saftey is related to interest rates demanded because of default risk.

"we can roll Trust Fund bonds into regular Treasuries." -what? what does that mean?

"No net change in public debt, perhaps some change in interest" What? Trust fund bonds are not traded and have a fixed interest. The float of Treasuries would increase.

"Of course we could cut of this possibility if we destroy our credit rating in Middle Eastern sands."

what? this does not make any sense. The US credit rating is not going to crap. the dollar is going to crap and that means that people are going to want a higher interest rate to hold on to it. This has nothing to do with the trust redeeming bonds.

hope this helps and I didn't make any mistakes.

thank you