Every so often, conservatives bring up the flat tax, wherein everyone pays the same amount of income tax, regardless of how much they make. Most of these plans, unless you want to eliminate the entire Pentagon, will raise the tax burden on the lower middle and middle class, and lower them on the wealthy, further increasing income inequality. But the whole argument presumes that the wealthy actually pay considerably more of their income in tax than the non-wealthy.

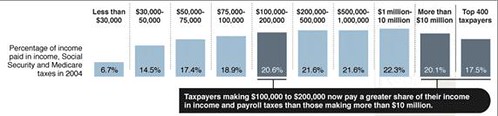

By way of Kevin Drum, comes this figure indicating otherwise--in fact, the wealthiest 400 Americans pay less than middle class families ($75,000-100,000):

It goes without saying that the wealthiest Americans have far more income left over after paying taxes, which is one of the reasons why college education and housing prices have increased much faster than the median wage. You're competing with people who have far more post-tax income than you do. Good luck with that.

But what's really astonishing is that, once all taxes are factored in, we essentially have a flat tax. For $50,000 and higher, realized tax rates range between 17.4% to 22.3%. Sure, it's not identical, but I'm pretty certain that those in the top 1% can handle it.

Extra bonus observation: Most flat-tax plans don't eliminate Social Security taxes, and these taxes fall disproportionately on those who make less than $100,000 per year (there's a cap, so, for the wealthly, most income is not taxed). Middle class households would end up paying more of their income in taxes.

CONSERVATIVE WIN!!

The biggest difference between the rich and the rest of us is that, the further you go up, the proportion of their income that derives from wages and salary (and subject to income tax) becomes much smaller. Most wealthy people get the majority of their wealth from capital gains, which is taxed at a rate about half that of wages and salary.

This isn't real hard to figure out from gross budget numbers. Social Security payroll taxes account for 34% of Federal revenues, and all income taxes account for 45% (corporate taxes, tariffs, etc. are all pocket lint after those two.)

However, the payroll taxes are less than 15% and are (as noted) capped, besides only applying to direct compensation. So how low are income taxes, since the total is less than 50% over the payroll taxes? Not hard to figure out.

On the other hand, "flat tax" proposals -- at least the honest ones -- have two characteristics not mentioned: (1) they apply to all income (no special deductions etc.), and they have a hefty offset that makes them effectively progressive.

No tax law change will ever be without winners and losers, but several of the flat-tax proposals are at least pretty fair fits to the current distribution across income groups.

I thought most "flat tax" proposals were for a flat tax rate, with no deductions. I do remember a presentation about a so-called "Flat Tax", where everyone pays the same amount, but the government cuts a check for that amount for everyone below some cutoff value. Is that you're talking about? That "Flat Tax" is one crazy boondoggle.

Actually, no one every proposes even a flat tax. A true flat tax would be a political parrot, dead before it left the store. What they propose instead is a progressive tax with two brackets, 0% up to the income limit of the first bracket, and x% after that. The disadvantage to large discontinuities, of course, is that it creates perverse incentives around that income level. It's far from clear to me what advantage there is supposed to be to two brackets over three or four. Most of the claims made for the not-really-flat tax are nonsense.

Russell I believe what you refer to is http://www.fairtax.org/site/PageServer.

What this blogger refers to is the basic theory that many American's think they understand and the principle they're given to picturing in their mind's eye is one of evenness and equality. Obviously, the principle doesn't necessarily translate that way.

hey guys

i think Obama is trying to make taxing easier for the people. God is good. Amen