Recently, some people have been asking if Wall Street, Big Shitpile and the other elements of the Great Pandimensional Economic Clusterfuck of 2008-2009 would have been as bad if women were more common on Wall Street. My answer: absolutely not. What follows are some personal experiences as to why I think this.

Many years ago (OK, around 2000), when people, by and large, still respected Wall Street and investment bankers*, I was often told I was being wimpy for putting most of my 401(k) money into U.S. securities and bonds (GIRLIE MAN!), instead of stocks and other high-risk, high-yield investments (balls, dude!). Here was my thinking at the time (and it really hasn't changed much since then):

1) I thought stocks were overvalued. When you looked at the price-earnings ratios, across the board, they were far too high. Unless you believed that the entire board was suffering from temporary underperformance or had superb future earning potential, this was a collapse waiting to happen--and trying to predict its exact timing was foolish (see point #2). I'm sure there were some diamonds-in-the-rough or ugly ducklings, but I, nor most of the people giving me 'advice', were paying close enough attention to find them--and if you're buying an index fund, by definition, most of your money isn't going to those stocks. Which brings me to point #2....2) I'm not paying enough attention (you're probably not either). I'm sure if you're following the market (i.e., you're a professional), you might get in at the right time and get out at the right time (although many professionals don't seem to have timed it right either....). But I have TEH SCIENTISMZ!! to do. I'm not paying close enough attention (nor should I). Part-time amateurs shouldn't swim with the sharks. Know when you're out of your league and walk away. Everybody can't be the toughest guy around...

3) Machismo is not an investment strategy. When I mentioned what and why I chose the strategy I did, I often received subtle barbs about how I wasn't being aggressive enough (OH NOES!! MAH PENIS FELL OFF!). Women usually weren't this obnoxious, and actually considered what I was saying. Which brings me to point #4....

4) When someone is disagreeing with you in order to internally justify his own actions, more than trying to persuade you, do the opposite of whatever he's telling you to do. Mixing ego and feelings of self-worth with money is profoundly stupid--and in my experience, usually a male trait, not a female one.

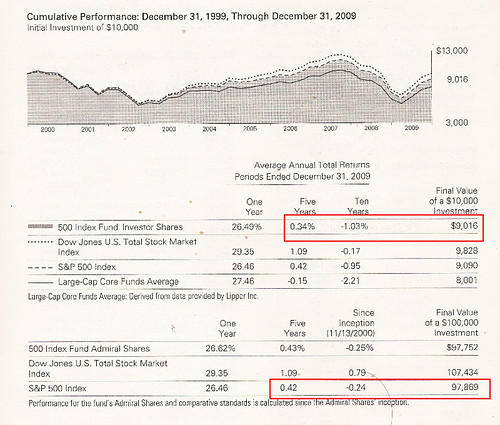

Having said that, while I put most of money, meager as that most was, in a bond fund, I did put a little in a 'high performance' fund. This means I receive both prospectuses and can compare their performances. So let's see how the Look at My Huge Swinging Cock, You Pencil Dick Wimp! Vanguard 500 Index Fund did (it contains stocks):

That's right, in nominal dollars, you lost money. In 2000 dollars, your $10,000 investment declined to $7,236.77, losing 28%. And don't forget the fees! Meanwhile, onto the You Lack a Pair of Balls, You Wimp! Vanguard Inflation-Protected Securities Fund Index Fund (which contains government and government-backed securities):

That's pretty darn good, especially when you consider I didn't actually do anything to earn this income, other than check the appropriate box on a form. Not very manly, I know--investing, CNBC propaganda notwithstanding, isn't cowboys or chainsaws. Use brains, not balls. For those keeping score at home, in 2001 dollars (that's when this fund began), if you started with $10,000, you wound up with $15,895, for a total increase of 59%.

Even worse, this difference wasn't due to the current depression, since stocks underperformed bonds from 2001 to 2007. They just haven't done well due to the underlying fundamentals.

Again, if you're sharp, you might find an angle (or you can always co-opt government regulators and make your own angle). But probably not: there are no free lunches or magic money machines; most of us actually have to earn our money. In my experience, women seemed much less influenced by ego-driven magical thinking than men--and that observation is borne out in a study of amateur investors. The point of this post isn't to impress you with how smart I am (because I'm not), but to note that ego and bluster have no place in planning your retirement or managing your money.

If you've been looking at the figures, you might think, "But Mad Biologist, the one-year return on the 500 Index fund is really high. You're not being fair. Besides, there are plenty of ten-year historical windows where stocks outperformed securities." Regarding the last part, do you think you're smart enough to find those ten-year windows? Because many reasonably intelligent people weren't.

As to fairness, well, there's a shortage of fairness going around: just ask a stocks-heavy 63 year old....

*Crazy, wasn't it?

the one-year return on the 500 Index fund is really high

So it is, but did anybody know that a year ago? I certainly didn't--I sold half of my Vanguard 500 Index Fund in March or April of 2008 (expecting things to go south, as they did about six months later), and the other half near the low in March 2009. At the time I thought further declines were likely.

Now that we've had this nice bear market rally, I look at the fundamentals and conclude that this market is way overvalued and due for a correction. The problem is that I thought this rally was over 1000 Dow points ago. As the saying goes, the market can stay irrational a lot longer than you can stay solvent. Going short is entirely out of the question--that would require watching the market even more closely than a long-only strategy would. OTOH, the bond run is probably also nearly done, since it depended on absurdly low interest rates, which I don't expect to stick around.

A case can be made, on theoretical grounds, for a sufficiently young investor to have some money in the stock market. But only if your time horizon is long--minimum 10 years, 20 is better--so that you can ride out downturns. A 63 year old should not be heavily invested in stocks. There was an old rule of thumb that your bond allocation percentage should equal your age, with the rest in stocks. That advice is almost certainly too aggressive today; our hypothetical 63 year old might be okay with 17 percent in stocks, but not 37 percent.

Except that in the recently passed housing bubble, it wasn't just stock market traders buying tech stocks based on fantasy valuations, but people--individuals, couples, families--buying houses based on fantasy valuations. And women were involved in those decisions just as much as men. And there was certainly plenty of magical thinking involved.

And there's a difference between Wall Street traders and bankers and amateur investors--the reward system--your pay, your status, everything--depends entirely on how much profit you make for your company. If you're going to play on the Street, whether you're a man or a woman, either you're a shark or your shark food. That's a part of the culture that's not going to change any time soon.

I tried to play the stock market, and rather quickly lost $3000 on companies going bankrupt. So my tax-sheltered annuity has always been in a fixed interest account. It has gone as high as 17% and is presently at 4%. I've taken more out than I put in, and have more left than I put in.

You gave yourself a best case scenario. Does it work as well for any 10-years starting with a year other than 2000? NASDAQ hit 5000 briefly in March, the Dow was at a peak during the first quarter.

I agree that women, by and large, are less prone to ego-driven bets in equities than men.

I don't feel that this is the same for all types of financial instruments (the consensus [myth?] is that the yen funded carry trade was heavily supported by Japanese housewives), and certainly in my experience, both women and men seem to find it equally hard to do nothing at all.

Eric Lund: The version of the rule I'm familiar with is that the percentage stock allocation should always be 80 minus your age, giving your 17%. The 20% leftover should be in cash. Quite possibly this is the emerging market version, where risk-free government debt in your home currency does not exist.

I don't like the blanket statement that women wouldn't have been as pressured to be as risky as the men. I think it's more accurate to say, as studies have proven, that more diverse boards do better. A diverse board makes better financial decsions for a company, likely benefitting from the diversity rather than a "female" vs. "male" dichotomy. I had always read the rule (prior to the downturn) to be 100 minus your age should be your allocation in stocks. So a 30 year old should be 70% invested in stock. But then I read somewhere else (also prior to the downturn) someone who recommended an exponential approach; That younger people should have their portfolios almost entirely in stock until they hit their late 30s or sometime in their 40s, and then should make a huge shift over to bonds/cash.

I'm 100% invested in equities right now vs my more risk-averse husband has 10% in bonds. I knew a lot of coworkers who started pulling their money out or buying bonds when the market began to tank. When the DOW dropped to 11000 I knew that if the market was going to tank it was going to be a great time to buy and increased my 401k contribution. Since then it dropped to 7k and I had many months of being able to buy equities at those great prices. Now that it's back up again I've nearly tripled my account from the low time, and I have about twice as much as I did prior to the crash. I agree the market is overpriced right now, but that might mean a decade of stagnant returns rather than another crash. I also think my strategy wouldn't work for somebody older, and I plan to get into some bonds eventually, but not until it seems reasonable for my age. The advantage of using an age-based plan is you aren't influenced by the year-to-year fluctuations of the market, because male or female none of us can time the market.

some of us bought houses because we needed decent places to live, and every dwelling had a fantasy-based price. i knew i was overpaying for my house, but i bought it to live in, not as an investment, and it still beat the ratty old trailer i moved out of very handily.

at least i was lucky enough to get a good, fixed-interest mortgage that's not going to blow up on me. if not for that, i might have been better advised to just get a newer trailer... naah, i can't even kid myself into thinking that.