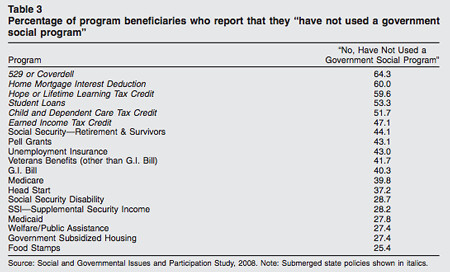

Anyone who follows politics regularly is aware of the phenomenon of the voter who "wants the government to stay out of my Medicare" (Medicare is a government program). But a huge fraction of recipients of government aid do not believe they have received government aid. I'll get to why I think that's the case in a bit, but first consider this chart:

Like I mentioned, mind-boggling.

How can 43% of those who received a Pell Grant--college aid--not know that it came from the government? Not only is it all over the grant application forms, but, presumably, at least some of the recipients were smart enough to get into a college and, maybe, even graduate.

Veterans benefits aren't government aid (41%!?!)? How is that possible? One argument is that these programs are invisible:

Mettler argues that any real reform that involves these hidden non-state actors must begin with explicitly making the invisible visible to the eyes of the public. It takes time and effort to bring the machinery of the submerged state up into the light of day, but it's necessary -- and effective. Obama's effort to restore direct federal funding of student loans was a good example of this. The banks were making billions each year off this program, at the expense of millions of students who should have been getting that money instead. He was able to pull this off because activists and journalists had already spent several years hauling the ugly wreck of a policy up into public view, which weakened the ability of banking lobbyists to defend their position. By the time Obama arrived, they were weak enough that he could demand -- and get -- a complete end to this lucrative subsidy.

I think this is overthinking the problem. This seems a case of willful ignorance by definition. Government aid is for lazy slackers, for 'welfare queens', and, in some people's minds, for those people. Decent, hard-working people don't receive government aid, even when they do. In other words, any program that helps middle-class people, people like themselves, is, by definition, not aid, because government aid is inherently pejorative.

This just shows how toxic conservatives have made our discourse--and how Democrats and progressives have failed to challenge that poisoning.

I agree with the tone, but all the "Tax credits" are not government aid.

Tax rates are tax rates, calling something a "credit" is bogus, as if the government had a right to that money otherwise. It is just a lower tax rate. It is not government -aid- when someone gets less taxes. The fact that people even think that is enough to get some folks to become tea baggers, and to forget that is to drive more there.

Lower tax rates may not "seem"like a credit to you, but they are. You might think the government has no "right" to the money, and you have an argument to make (although it's a pretty thin argument)... But you can't just SAY it and assume it's true.

It's government aid.

The fact that the tax rate is what it is is a fact. (And it's a pretty meager amount.)

I'm skimming the text of the report, and Mettler does talk a bit more about the tax credits. Of note:

In other words, whether or not you consider tax credits to be "aid", receipt of said credits doesn't significantly alter an individual's perception of their tax burden, unlike education and overall income. Which still fits with the primary thesis, which is that government aid/assistance/having-less-income-confiscated-by-threat-of-state-sponsored-violence -- or however you want to tilt the frame -- is invisible to most of the people who benefit from it.

Legislators like to give tax credits because they are not considered expenditures. It's a sleight-of-hand. Typical Enron-like govt. accounting.

Joshua would clearly prefer individually sponsored violence to state sponsored violence.

Maybe if you don't have any government backed money, don't insist on any government backed rights, don't own any government enforced property, maybe, just maybe, you might get away without paying taxes. Things like private property, security of one's person, and a capitalist economy don't come for free from the Laissez Fairy, they are government functions and they get paid for by government enforced taxes.

I won't take issue with calling narrow tax cuts and credits "social programs" in this context, but I do think that depending on the specific benefit, veterans' benefits shouldn't necessarily count. If those benefits existed before the soldier joined, they're more accurately considered part of that soldier's compensation package.

I say this because I often see veterans' benefits of all sorts pushed into the "social programs" budget rather than the military budget when talking about how much of the government pie each program takes. That seems to me to be fundamentally unfair and inaccurate. If it's dollars you spent to give an incentive to join the military, then it's military spending. The fact that it takes the form of health care or some other non-cash benefit doesn't suddenly make it a social welfare program.

Differing Tax rates are NEVER subsidies. They may be unfair (generally they are) or targeted or whatever. But subsidies are when tax money or fee money or other government money is SPENT not when the government is taking less from some than from others. If you conflate the two you end up with teabaggery just as we have. It is just a whacked out "progressive" tax system.

Markk:

Let's say we have 10 people in our country. We each pay $2 in taxes for a total tax burden of $20. We decide to subsidize college for two people. Now, our government tax burden becomes $22.50. Everybody pays $2.25. We then give $1.25 to each of the two college students. Net result: 8 people pay $2.25 and 2 people pay $1.

Alternately, we could give those two people a tax cut of $1.25 and keep everything else the same. Unfortunately, now we're only receiving $17.50 in taxes to pay for the $20 in services. So everybody's taxes go up by $0.25 to cover it. Net result: 8 people pay $2.25 and 2 people pay $1.

Your model seems to construe these things differently. Legally, they are different. In reality, every time we tweak the tax code to favor somebody, we're increasing taxes on everybody else to cover it unless we're cutting that exact amount out of the budget. Congress likes to give these kinds of "tax cuts" because they can curry favor with giveaways without being accused of tax-and-spend policies, but let's not mistake them for what they are: subsidies that come out of somebody else's pocket.

I support government programs. I support progressive taxation. I think that a ten billion page tax code full of exceptions as backdoor tax hikes is an inefficient and politically cowardly way to achieve those two goals. It also has a nasty side effect that the people who receive government handouts often don't seem to know it.

Hmm, as a recepient of both a Pell Grant and the GI Bill, I'd like to differentiate. A Pell Grant is gov't aid, full stop, no question. But Veteran's Benefits or the G.I. Bill? They are no more "aid" than the salaries or housing allowances we received when on active duty. Pay for services rendered. The G.I. Bill and post retirement Medical Plans were both part of that contract; so despite being paid for by the taxpayer via the treasury, I would not call them "aid".

But believe me, every time a veteran hears the calls for cutting aid and benefits, the smart ones know that we are targets just as much as uncle Ronnie's "welfare queens".

Glenn

As somebody currently receiving the New GI Bill to go to school, hell yes it's Government Aid and I love it. I'm not egotistically blind enough to deny that I'm getting government aide. The issue isn't that people get government money. That's not what sets the tea party crazies on edge. It's who's doing nothing but get aid and who's working hard or has worked hard (and therefore deserves a helping hand).

The people that get mad about welfare queens do so because they don't think the people they label as welfare queens are contributing to society and deserving of government help. The problem is each person has their own definition of what 'contributing to society' really is and the people getting government handouts never seem to think that theyâre a welfare queen. Thatâs the other guy.

@Kaleburg "Government-backed rights"? Our rights are not bestowed by the government!! They are inherent in our existence and endowed by the Creator. The Constitution provides a list of things the government cannot do to infringe on our rights.

I would argue the point on your classification of veterans' benefits as social programs. If they are, then so are government employee medical benefits and pensions. Military members are employees of the government and are promised such benefits as a condition of their enlistment.

The government has every right to the money you hold. It establishes currency, it maintains its worth, and it protects, or fails to protect, it. Through monetary policy and taxation the government can make your saving worth more, or less, or remove what money you have entirely. You have little, if any, control over it. You work, live, spend, and will die within a monetary system. That is the point of money. That, and it works. Utility counts for a lot.

If you want to play with another currency you play by their rules but you are no more free of their control. You likely won't because the US dollar has many advantages over other currencies. Being both the international reserve currency, and having all major commodities priced in US dollars, has a lot of advantages. There is no place on earth where the dollar is not recognized as valuable. It is good to be king.

If you want to avoid money entirely you can barter or work in some communal system free of money. You are free to try. Most people don't like the result and almost without exception everyone gets back into the money system.

You could convert to gold as a way out but it to is not without problems. First, you pay a premium to buy it. If you accept physical possession you have to store and protect it. If you don't you are never sure how much you really have and get into a confidence game as tortured as any fiat currency. When you sell it you pay another premium. But even then you face two major problems. You can't easily buy things with gold, and gold prices are even easier to manipulate than the value of the dollar. You haven't escaped. You have just traded one system for another.

In the end the conclusion is, must be, that fiat money, particularly US currency, is unfair and dangerous, and it means you are dependent on things out of your control. But all the other systems are worse. It is still the best game in town.

So yes, the government owns the money. They just let you hold it occasionally. That's the way it is. Come up with a better system or accept the one you are in.