There has been an awful lot of fluff written about the LIBOR fixing stuff in the past week or so. Which is why I looked forward to my friday afternoon at home reading the Economist - in a brief patch of sunshine even - and getting a more considered opinion, and perhaps even some facts. They seem to take it all very seriously, whereas it seems to me there is an element of moral panic in the air (hey, you're here because you want my opinions - if you want informed opinion, go read an economist).

There has been an awful lot of fluff written about the LIBOR fixing stuff in the past week or so. Which is why I looked forward to my friday afternoon at home reading the Economist - in a brief patch of sunshine even - and getting a more considered opinion, and perhaps even some facts. They seem to take it all very seriously, whereas it seems to me there is an element of moral panic in the air (hey, you're here because you want my opinions - if you want informed opinion, go read an economist).

First, a throwaway thought: Barclays is suffering from having "come out" of the closet first. This looks to me like a bad miscalculation on their part: they thought they would get credit for cooperating and coming clean. Instead, they are taking all the flak. Others, I'm sure, will learn the lesson from this and start dragging their feet: who would want to be number 2? Far safer to be number 10.

..two types of bad behaviour. The first was designed to manipulate LIBOR to bolster traders’ profits. Barclays traders pushed their own money-market desks to doctor submissions for LIBOR (and for EURIBOR, a euro-based interest rate put together in Brussels). They were also colluding with counterparts at other banks, making and receiving requests to pass on to their respective submitters... This bit of the LIBOR scandal looks less like rogue trading, more like a cartel... The second type of LIBOR-rigging, which started in 2007 with the onset of the credit crunch, could also lead to litigation, but is ethically more complicated, because there was a “public good” of sorts involved. During the crisis, a high LIBOR submission was widely seen as a sign of financial weakness. Barclays lowered its submissions so that it could drop back into the pack of panel banks; it has released evidence that can be interpreted as an implicit nod from the Bank of England (and Whitehall mandarins) to do so. The central bank denies this, but at the time governments were rightly desperate to bolster confidence in banks and keep credit flowing. The suspicion is that at least some banks were submitting low LIBOR estimates with tacit permission from their regulators.

That isn't a new distinction, of course, just what is obvious to anyone who has thought about it.

Start at the end

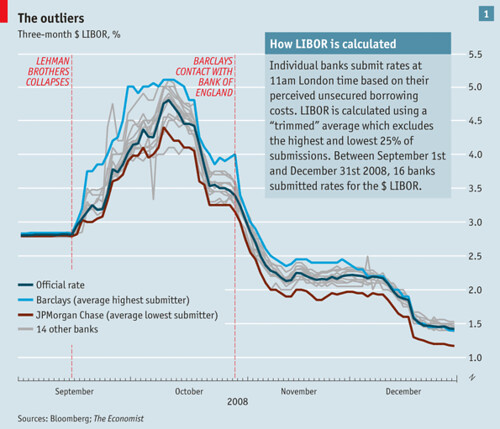

Lets look at the second bit first. Here is a nice graph I ripped off from them:

Now you need to know another Killer Fact: LIBOR is a trimmed average: they take quotes, throw away the top and bottom quartile, and average the remainder. Which means: if you're the top quote, and you reduce your quote down to being just above the 4th-top, then... nothing changes. And it looks to me like that holds true for Barclays up till, say, early December 2008. After that its hard to say: you'd need to do a more careful analysis to see (but the Economist says In its settlement with regulators, Barclays owned up to massaging down its own LIBOR submissions so that they were more or less in line with those of their rivals. It instructed its money-markets team to submit numbers that were high enough to be in the top four, and thus discarded from the calculation, but not so high as to draw attention to the bank (see chart 1). “I would sort of express us maybe as not clean, but clean in principle,” one Barclays manager apparently said in a call to the FSA at the time.). And as the Economist points out, there were several other banks during that period producing far far dodgier submissions.

The other factoid about those times, of course, is that it was during the Great Panic, and no-one wanted banks to collapse if it could possibly be avoided. Having to pay a high interest rate was a bad sign, which is where the contacts with the BoE come into play:

Mr Tucker stated the level of the calls he was receiving from Whitehall were “senior” and that while he was certain that we did not need advice, that it did not always need to be the case that we appeared as high as we have recently.

Apparently Tucker (deputy BoE chair) insists that he wasn't asking Barclays to massage its quotes down, oh no indeed not at all who could possibly think such a thing, and the Economist gamely tries to believe him, but... no. At such a time, that's a bit of a heavy hint, isn't it? I think its clear how you'd interpret it. So the regulators were complicit, and indeed this was "ethically more complicated" because it may actually have been good, not bad. We all tell little white lies on occasion.

LIBOR fixing of the first kind

Which brings us back to the bit I ducked, the first round of LIBOR fixing, where the traders and the quote-givers were collaborating. No-one has a good word to say for this, and even Diamond says this was "reprehensible".

Who ya gonna sue?

The worst aspect of this is probably the vast quantities of pork that will be thrown at corporate lawyers and a variety of injured, possibly injured, and not-at-all-injured-but-doing-their-best-to-throw-a-foul folk line up to see what they can get (bloody Radio 4 wasn't immune to this, the fools). Almost inevitably some people will have lost and some gained; those who've lost will want recompense but those who've gained won't want to hand anything back. Perhaps happily, it will be in many cases quite unclear who has been affected.

Fixing it

There is a whole load of pap about reestablishing trust, which I'm not sure I believe (its just like making laws or sausages). For LIBOR, the obvious fix is to move to actual rates used rather than guesses, since those are verifiable and much harder to game (yes there is a problem with various currencies and maturities, but with actual rates to pin the structure the guesses for the holes matter much less).

But there is one ray of hope: apparently its a political fight to the death so there may be a few fewer pols around.

[Update: oh yes, I forget the disclosure: I own shares in Barclays]

Update: Tucker: "I'm clueless"

As expected, Tucker appeared before MPs and said he was clueless about the manipulation, and oh no indeed not at all did he ever suggest or even imply that any manipulation would be a good idea, good gracious how could you possibly suggest such a thing?

According to his memo, Mr Diamond explained to Mr Tucker that “not all banks were providing [LIBOR] quotes at the level that represented real transactions.” Mr Tucker told the committee that he took this to mean that other banks, which had submitted LIBOR quotes, but did not need to raise cash, had under-estimated their likely borrowing costs. He did not interpret Mr Diamond’s remarks as blowing the whistle on the misreporting of LIBOR, Mr Tucker said—and that he wasn’t aware of any allegations that banks were deliberately “low-balling” LIBOR rates until very recently.

which is incoherent. Barclays told him that people were lowballing estimates, Tucker understood that people were lowballing quotes, but he wasn't aware of any allegations that people were lowballing quotes. Tucker had a hard line to try to hold: he was innocent, obviously, and hadn't a clue that Bad Things were going on (obviously, or he'd have done something about it, obviously). But there is no way to reconcile that with actually having a clue and being competent, and it doesn't seem that he tried to do that last bit. The Economist are still being very easy on Tucker; I can't see that being from shiny motives.

Refs

* There are some interesting graphs but (IMHO) some dodgy conclusions at The Aleph Blog. This one makes more sense, though.

* Plumbum.

* Timmy reports the Torygraph.

* ahref="http://www.thedailymash.co.uk/politics/balls-is-a-vampire-says-osborne-2012071133825">Balls is a vampire, says Osborne

The Economist was out in front of this story - from April:

http://www.economist.com/node/21552578

http://www.economist.com/node/21552586

It's easier to have an informed opinion when you follow something all along, as opposed to quickly trying to react when the news breaks.

Yes, indeed, "if you want informed opinion, go read:" e,g,

http://www.nakedcapitalism.com/

http://www.nakedcapitalism.com/2012/07/yes-virginia-the-real-action-in-…

rather than the Economist.

The points of this post or the Economist's essay seem to be:

- If it was a lie, it was excusable (avoid panic and such)

- It was not such a big lie (mostly not included in average)

- nobody got injured, or it is just too complicated to find out who got injured. But the enhanced trader's profits were someone else's losses.

Now if your pension fund just got sold some derivatives as a hedge depending on the LIBOR, and did lose money with it would this also be ok with you? After all your share of the loss is also only probably a few dollars.

But the value of Eurodollars futures traded in 2011 on the CME.(Chicago Merc.Exchange) was over 564 trillion US dollars, so a few points here and there make for a fine bonus.

The whole thing indicates that if you are a small investor, you are a fool. And likely, your pension fund or your city's municipal bond investments will happen to be administered in such a way that it too often ends up on the losing end of manipulated trades. The economic function of Wall Street and the City is to fleece the populace.

Here's another good explanation how rate manipulation

hurts especially municipalities and similar bodies:

http://www.ritholtz.com/blog/2012/07/the-big-losers-in-the-libor-rate-m…

> reestablishing trust

But trust is vital to the way our economy works!

http://www.economist.com/node/21543526

[That's an odd link to give for that assertion, because its about, well, Ponzi schemes, and Church Pastors fleecing their flock. Those are rather different issues -W]

I for a while, years ago, carefully read the fine faint brown-on-grey six-point print on the back side of the 'variable rate' credit card and mortgage offers then flooding the snailmail, to see if I could make a sensible comparison of the terms offered. Back then, most of the rate change terms were based on changes in LIBOR.

[Yes, that's right, many things are tied to LIBOR. So, if you've benefitted from a slightly lower rate, will you be thinking of offering any back ;-? -W]

I was wondering what it would actually be worth to those involved, so I did a quick analysis.

BIS tells me that there's $100 trillion of USD swaps outstanding, but ISDA says that 85% of them net out, leaving $15trn to be fiddled. There are 16 panellists, so assuming they all have equal market share, that's $937 billion each. Each swap can fix on any day of the year, so given 250 business days a year, that's $3.75bln fixing

on any given day. On a "big" day, it might be 20 times that ($75bln), and you might have 10 "big" days a year, for $750bln.

If you skew your submission by 1 basis point (0.01%), as the FSA doc says, it moves the rate by an eighth of that, which changes the value of that $750bln by just short of $10 million, if you can pull it off consistently. That's a big "if", though, because there are people with the opposite side of the trade presumably trying to skew it the other way. Let's assume your success rate is 50%, so the revenue stream is $5mln/year. Real money, but small beer in a corporate context.

What does this translate to in the most important number, the trader's bonus? Well, banks accrue about 50% of profits to the bonus pool, but the desk doesn't get all of it (there are all those legal, compliance, operations and technology people to pay, not to mention the senior

management types). Let's say 40%, so it's $1mln/year.

Between the derivatives and funding desk there are probably about 10 traders getting any kind of serious money, and we can't tell what level traders were doing this, so let's just split it equally giving a bonus bump of maybe $100k, i.e., £65k/year?

That said, I suspect the 50% success rate is too high--possibly by an order of magnitude--and the real value is more like £7-14k/year. Nice enough, but I wouldn't risk jail for it.

Refs:

http://www.bis.org/statistics/otcder/dt07.pdf

http://www2.isda.org/attachment/NDQzNQ==/Market%20Analysis%20060612.pdf

http://www.fsa.gov.uk/static/pubs/final/barclays-jun12.pdf

[Interesting calculation. This applies to the "first part" fixing, of course. I think... well, that yes the amounts involved in terms of profit were probably relatively small; but that nonetheless the "profit at all costs" kind of hunger-culture might have induced people to do it anyway; maybe on the "oh, I wonder if we can do this" kind of level. That would fit the apparently small level of rewards - bottle of Bollinger kind of level - that were apparently being offered. Another thought is that comparatively little seems to have been written about this bit, I'd like to see more. Maybe it will come out more clearly with the other banks -W]

During the crisis, the banks weren't lending to each other. So what rate do you report when there isn't any interbank lending?

[This is a bit of a problem that many have noted. It also means that the direct profit/loss anyone many on the fixing at this point was small; but of course (as Hank points out) that same LIBOR has effects elsewhere -W]

On the fix, yep, it should be a weighted average of transactions. That way a single small trade at the end of the day won't mess with the numbers.

The real scandal is government involvement. They are up to their necks in it.

However, the underlying agenda is this. Governments are in a mess because they are committing a fraud. None of their pension liabilities are on the books. Those liabilities are massive (just for accrued liabilities) to the extent they can't pay them. So they are engaged in a distraction game. Blame others - the bankers - for the mess and the public might believe you.

Remember too there is a distinction between the bankers who were wrong and the ones that were correct. Read lots of the statements about bankers and change the word banker to Jew or Black. Ask yourself would that statement be acceptable? Most aren't.

It's going after a group on the basis of the behaviour of the few.

[I'm inclined to agree; bankers are deeply unpopular right now, and this is something wrong that bankers have done, therefore it must be a Very Bad Thing Indeed. I guess another probable conclusion to draw from that is that the govt and BoE here are likely to collude and push the blame onto the banks, so expect the MPs to give Tucker an easy time -W]

On bonuses for a banker - 5% of profits. 95% goes to the company.

Of the 5%, 50% (in the UK) goes to the state in taxes.

(Sorry about the line breaks. Sb, Y U no preview no more?)

[We no do permalinks either, they promised to fixup that quick -W]

Good compilation of links here:

http://www.metafilter.com/117649/Structural-change-in-high-finance

Excerpt:

"... John Coates, a former Wall Street derivatives trader and now a neuroscientist at the University of Cambridge, has done novel research on how testosterone skews the thinking – and thus the behavior – of traders, inspiring them to take on more risk than benefits society...."

[I didn't get a lot out of your last link; I can't quite see the argument being made there. But is it surprising? Risk levels in trading are not optimised to benefit society - you wouldn't expect them to be, would you? -W]

> to benefit society

They're protected on the notion they do benefit society, as bankers handling other people's money.

[As of course they do, though I'm not terribly convinced by your "protected". Out Western economy wouldn't work without a banking system - you know that already, why are you pretending you don't?

But your original context was "traders, inspiring them to take on more risk than benefits society" - I took that to mean you were arguing that traders whould be taking on the optimal risk, designed to benefit society. That is a totally different question. Apart from anything else, you're failing to distinguish the different parts of banking -W]

It's not the money lost on their own account that bothers people. It's that social contract notion that society protects and provides for and rewards those who are responsible for others' property, and that they make responsible economic decisions.

[Errr, but this is getting a bit silly. That isn't how people think, and it isn't what happened. What I think you're describing is the fairytales that pols and press spin people when they want to wind them up. But that is emotion, not reality -W]

Yes, of course that's nonsense. As he says

"... then the markets are a very different kind of animal, one that is not as responsive to price signals as economics assumes...."

And that's why these attempts every few decades to make rules to distinguish banking from trading.

That seems futile -- these guys aren't just playing from the high side of the playing field, they're tilting the pinball machine:

http://www.nxcoreapi.com/aqck/3271.html

Social contracts, like taxes, are for the little people.

I picked that one out of the air from many discussions of the difference between banking and trading and gambling -- but it's a surprisingly deep site. This is on point about costs and social benefits, I think:

http://www.nanex.net/Research/ExhibitA/ExhibitA.html

[Well, its about different peoples interests, no? Good old tragedy-of-the-unmanaged-shard-resource stuff. Some people make money out of putting lots of quotes through, and so they do it. Because the people who notice are the Evil Bankers (see previous comment...) no-one much cares, unlike spam, which affects us all unless we use gmail. But (as that post points out) the regulators are starting to notice; and if they can do something about it before the economic status of the quote-spammers becomes large enough to allow them to get their say, I suppose it will be in some way regulated. Assuming it is an Evil of course; that page suggests so, but is hardly conclusive -W]

> tragedy of the unmanaged

Financial systems are unmanaged commonses, available for the taking?

Well, that explains a lot.

I appear to have been misinformed.

[No, I didn't say that. Finance is heavily managed, you know that.

And I deliberately didn't use "commons", because commons implies managed. But you know that too.

What I said was that (and I suppose I should have qualified this with "if I believe your link") the quote system is unmanaged, or only partially managed -W]

"Barclays is suffering from having “come out” of the closet first."

Nope, they were up front about it all along ;)

> quote system is unmanaged

Ah, that helps. I should make clearer that I'm not pushing an agenda on this, I have no idea if it's a solvable problem and assure you I have no system to put in place if empowered to do so.

The US tried control, that's where the SEC came from. I don't know much about how it works in the UK -- except that this "City of London" has so much independence and privacy for trading that much of the world's business is being done there. Somehow.

[I don't think that's quite right. You're (Frank-Dodds, have I got that right?) doing your best to foul up your trading system right now, but London has other advantages; but you'll need someone else to say what they are. Timmy could explain -W]

The financial lobby defeated attempts to regulate accounting -- that's why we have "generally accepted accounting principles" as the criterion rather than rules and regulations such as a dentist or carpenter or notary or other professional* is required to follow.

[That sounds like something read on a blog, not too dissimilar to "of course, all GW data is faked" which is the sort of thing you'll find confidently said on the septic blogs. And the idea that banks and "the finance lobby" is free to do what it likes is just wrong -W]

Justice Frankfurter in response to the proposal to create the SEC wrote:

"... It’s awfully easy to write these nice laws for control. I think your lawyer-banker friends would be glad to write them for you, but when I think of the stuff that gets by even high-minded judges – well I prefer to use the taxing power ... to curb the mischief and abuses of corporate activities. ... Tax ‘em, my boy, tax ‘em, and otherwise reduce the opportunities for bludgeoning that interrelation and concentration of money interests make possible.51

/51 Letter from Frankfurter to Douglas, January 16, 1934, William O. Douglas Collection, Library of Congress.

excerpt from: http://www.law.umich.edu/centersandprograms/olin/papers.htm

[404. I'm not sure what you intend your quote to say: you're suggesting that the judge was opposed to the creation of the SEC, and proposed taxation instead? I'd got the impression that you were in favour of the SEC and regulation in general -W]

I know a financial system is necessary, and doubt we could design and build one from scratch near as good as the one that's grown up from barter face to face to what we have now.

But the one we have does have these patterns. It's an ecology, not a machine. Occasionally some component takes too much of the resources and the system crashes.

I agree some of it is mostly unmanaged. Retail consumer banking was, supposedly, managed--for 50 years -- under Glass-Steagall. Then it took, what, five years to collapse once those rules were lifted.

[I think that's wrong, in your implication that the two are causally related -W]

David Brin checks in today on this. He agrees with Frankfurter: http://davidbrin.blogspot.com/

Programmers are kind of like accountants, aren't they?

"If carpenters built houses the way programmers build programs, the first woodpecker that came along would destroy civilization." — Weinberg's Second Law

Regrettably it seems accountants are like programmers, and traders are like woodpeckers.

Can a financial system be grown, cultivated, built, controlled, harvested, trimmed -- constrained in any way so it doesn't occasionally destroy much of what's been created?

[That is apocalyptic. We're currently whinging about the lack of growth, not the destruction of real things. What are these wonderful things that have been destroyed? -W]

Can't link to the little bit from Brin's large page, that I referred to above so here's his quote -- it's about your country. More sources explaining this City of London entity, please?

----excerpt follows------

[But... but... David Brin is a sci-fi author. Like Michael Crichton, remember him? -W]

Our Wall Street friends are offshoring even their own subordinates’ jobs...

David Cameron held his first meeting with Francois Hollande and threatened to veto the new French president’s plan for a European tax on financial transactions.

[I should hope so. The FTT is an stupid idea. What makes you think otherwise? -W]

The Prime Minister made clear he will block any French move that would harm the (banker-financiers) of the City of London. Many of you have seen how firmly I support the transaction fee which - at 0.1% - would scarcely be noticed by humans like you or me, but shift power away from a few brokerage houses doing High Frequency Trading (HFT) which inflates bubbles, creates wild speculative swings, dashes in to rob buyers and sellers of the “price difference” they count on... and may (as I explain elsewhere) lead to the "Calamity of Skynet.”...."

[Evidence? -W]

Further analogy to ecology: taxes as wolves, traders as deer, and the financial system as the living layer on the mountainside.

"... as a deer herd lives in mortal fear of its wolves, so does a mountain live in mortal fear of its deer." -- Aldo Leopold

> regulation .. SEC

I'm in favor of some form of government and constitutionally not predisposed to some of the alternatives, but I do imagine improvements may be possible. And I found the history of the Depression -- my dad at 12 was supporting his two siblings and two parents, because he could do trigonometry and got work surveying rural land. There was no other work. Ten years after that he was in the Army in Belgium and my mother was traveling alone around west Texas doing social work. The history of how the US put its financial system back together the last time -- creating the SEC among much else -- has a lot to teach people about why people get together and create governments. Regrettably it also teaches that war works wonders to revive an economy if it's fought on someone else's terrain. Your parents would've had a different perspective.

My dad described seeing the V2s falling onto London, too, on his way to Belgium. Did you know they did less damage than the V1s, beause they buried themselves much deeper before they could explode?

So I think about how financial crashes tear up people's lives with some of those stories cautionary.

[Could be. But the long-term march is upwards. Perhaps some wiggles along the way are necessary. Or put it another way: suppose we could have two different standard-of-living curves: the first rises uniformly at 1% a year. The second rises at 2% on average, but with insert-your-own-variability-here variation. Which is better? -W]

If we can understand why adding a smidgen of CO2 changes the climate, surely we can figure out why economics surprises us.

> sounds like

actually I read accounting history for a few years off and on, out of curiosity. It's not boring green eyeshades all the way down. There's more thrill, excitement and danger than you'd imagine.

And what got destroyed? Do you know how many empty and decaying and incomplete buildings there are now? Sure, blame termites and rain and scavengers instead of bankers -- but it's the credit system that quit working a few years ago. Yeah, lot better than a war. Let's hope it keeps improving.

[You mean the foreclosures you have, and the property boom-n-bust that Spain had? That wasn't really the credit system quitting working that did that - it was more that the boom was unsustainable. People were taking out loans that they manifestly couldn't pay. I'm sure I've had this argument in the comments with people before: for some odd reason, giving loans to people that can't pay them makes the person giving the loan Evil, and the person accepting the loan Totally Innocent. I don't understand that viewpoint -W]

I assure you I'm not making this up nor giving you wackjob claims. It's an area much studied, as they have this notion that being a "certified public accountant" is a public service responsibility. At least in the US. That's why accounting firms resign rather than sign dodgy books.

This kind of academic work === histories of history, how what 'everyone knows' changes from decade to decade and how it takes decades to unearth information deeply buried as it happened, mostly.

"The paper briefly examines two areas, the emergence of double entry bookkeeping and cost accounting, to demonstrate the new insights that critical historians have provided to what has been considered a settled agenda...."

http://www.sciencedirect.com/science/article/pii/S1045235498902660

Here's the one that came up 404. Seriously fascinating history. Why tax them? Reasons quoted above from Justice Frankfurter in the 1930s.

For that matter, I'd say same reason as taxing carbon -- the behavior that's the problem externalizes costs and keeps profits, damaging society; and because a tax may work to constrain the behavior, while, nothing else appears likely to.

http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1270667

Securities Law and the New Deal Justices

Adam C. Pritchard, University of Michigan Law School

Robert B. Thompson, Georgetown University Law Center

Virginia Law Review, Vol. 95, 2009

U of Michigan Law & Economics, Olin Working Paper No. 08-014

This is history of history -- historical study of information that wasn't available or wasn't in what we got taught in school about how the world works. It's difficult to believe some of it.

[I'm still baffled, I'm afraid. Your link now concludes "Finally, we explore the relative lack of influence of Douglas and Frankfurter in these cases, despite their familiarity and experience with the securities laws". But I thought you were putting forward Frankfurter as influential. Or are you just saying that you liked his ideas, even if no-one else did? -W]

"[But... but... David Brin is a sci-fi author. Like Michael Crichton, remember him? -W]"

Not really. Brin has a PhD in some kind of space science.

[(a) a PhD in space science 30 years ago doesn't make you a space scientist and (b) even if he was a space scientist, so what? -W]

Anyway, we have yet another eye-opener, this time how much the City spends on lobbying our elected legislators, and the unelected. The "parasites" are beginning to feel a bit miffed with the "Atlases" (blame Ayn Rand for the terminology, although why anyone would base any approach to a national economy... cough Greenspan ... on a failed screenwriter, not even an economist, is a head scratcher).

Hank -- "David Cameron held his first meeting with Francois Hollande and threatened to veto the new French president’s plan for a European tax on financial transactions."

There's a strong case for such a tax, whereby it could claw back the £2.5 trillion shortfall from lost seignage here in the UK.

["seignage"? You've got me there -W]

That's the national debt sorted.

[Ah yes the vast pool of free money. How silly of us not to have dipped into it before. But enough sarcasm: there is no vast pool of free money. The numbers bandied around are huge, but those are flows, not net accumulations -W]

Sir Robert Peel never anticipated plastic and the internet, and the amounts are as significant as, well, the cost of the coins and the notes in your pocket.

"[People were taking out loans that they manifestly couldn't pay -W]"

They were being told by the lenders that they could afford them. Weren't these people supposed to be the experts, or was it just that they were so unregulated (near zero) that they were able to turn a blind eye to fraud, even encourage it, and not even have their wrists slapped? If it had been PPI, the borrowers would be getting their money back.

Hank -- "Did you know they did less damage than the V1s, beause they buried themselves much deeper before they could explode?"

well, it was also a lot to do with having triple Agent Zigzag feeding the Germans creative stats on where they were landing, causing many of them to overshoot or fall short.

> are you just saying

Saying I'm wondering if there's more to learn as I see this issue getting dismissed with a few pithy phrases -- as it was 50 years ago. I've found the accounting history interesting reading for a couple of decades -- it's data about the economic climate, and no easier to either collect or explain than the physical climate.

http://www.condenaststore.com/-sp/Being-an-accountant-gives-him-that-ex…

> your link now concludes

You read only the abstract. The paper's there for anyone interested in looking up the quote I posted ("... tax'em ...").

For those who like that sort of thing.

Was it clear that these daily LIBOR-setting meetings were supposed to be occasions for the banks telling each other the truth about their actual borrowing costs?

-- telling each other the truth?

They weren't negotiating meetings for competitive advantage.

[What meetings? I don't think there is any implication that anyone actually *met*. They just submit their quotes -W]

They were supposed to, well, here's the WP:

"... Every day, major banks around the world submit their borrowing costs, which are then used to compute an interbank rate. Barclays was accused of concealing its borrowing costs — in an effort to drive up profits and send signals that the bank was healthier than it might have been.

The bank agreed to pay $453 million to American and British regulators to end investigations into the scandal, although other banks’ actions are being reviewed...."

http://www.washingtonpost.com/business/economy/in-2007-new-york-fed-was…

[Yeesss... But I don't understand. Why are you repeating old news? But you're missing the hint in your URL: "in-2007-new-york-fed-was-told-about-problems-with-libor" -W]

>meeting

of the minds, I believe they call it. Either someone does the computing referred to, or it iust happens magically, and then the Interbank Rate is announced, either by someone, or by magic. Meeting in the sense of stuff goes in, stuff comes out, the meeting presumed happened to process it.

>hint

oh, no, I didn't miss that, I read the whole thing.

"I don't consider myself a pessimist. I think of a pessimist as someone who is waiting for it to rain. And I feel soaked to the skin." -- Leonard Cohen

http://dealbook.nytimes.com/2012/07/12/geithner-was-aware-of-problems-w…

"Mr. Geithner then reached out to top British authorities to discuss issues with the interest rate, which is set in London. In an e-mail to his counterparts, he outlined reforms to the system, suggesting that British authorities “strengthen governance and establish a credible reporting procedure” and “eliminate incentive to misreport,” according to the documents...."

Thanks for considering what I had to say, even if I had some "dodgy conclusions." ;)

I don't have a dog in this fight; don't own any banks, and I just went where the data led me -- didn't know my conclusion when I started.

[John Hempton takes you seriously, so you probably know more about it than I do. I think it was the correlation stuff I was unconvinced by. Looking again, I realise I assumed this referred to the "crisis" time, but actually I can't tell what period it refers to - do you say? -W]

NPR summary from a week ago:

https://www.npr.org/2012/07/07/156428433/what-does-londons-libor-mean-t…

"... investment holdings that are pegged to LIBOR. I think The Wall Street Journal calculated $800 trillion of financial products."

Elsewhere I saw mention this might be a way to cancel contracts to buy or sell "credit risk" -- as companies can argue that a contract that used LIBOR can't be valid.

[I doubt that. Cancellation of all contracts that used LIBOR would be such a mess to the financial system. Also, its not clear the argument is even valid, unless the contracts contained a clause stating "this contract is void if LIBOR is manipulated" -W]

Several places also comment that having a tax on financial transactions would make lying about LIBOR more risky.

That's what caught Al Capone, after all.

[Don't follow the logic. Capone was caught for tax evasion. Lying about LIBOR wouldn't be tax evasion; and it wouldn't even be facilitating someone else's, unless done for that purpose (and a lower/higher LIBOR wouldn't necessarily alter the tax take on the hypothetical FTT, but that's more complex) -W]