tags: taxes, pet taxes, humor, satire

Image: Orphaned. Please contact me for proper attribution [larger view].

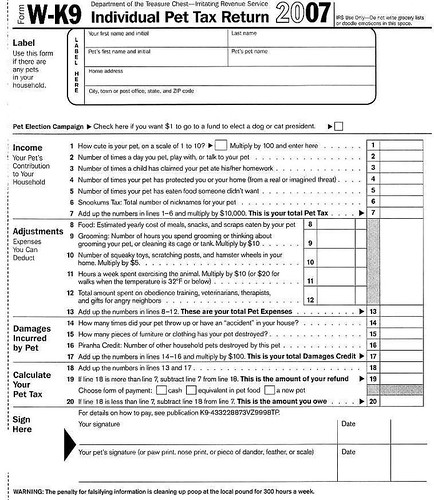

This form should be familiar to those of you who live in the USA, but if you click on the "larger view" link, you'll realize this is yet another change that President Obama has made to our existing tax code.

Once again, I ended up owing a huge amount of taxes (considering my laughable income). This year, I owe $500, but since I managed to qualify for the $300 "economic stimulus package," I only have to come up with another $200 instead of having to survive the trauma of scraping together the entire sum like I did last year. I am moving up in the world!

w00t! That is good news indeed!

I'm curious, why USA won't abolish these stupid forms for most of its citizens?

I've _never_ filed a personal tax return form in my life. Instead, my employer files a tax return for me every year and also automatically withholds tax from my salary. So I do not have to file a tax return myself (unless I want to claim some tax benefits, etc.)

Reminds me to get onto to my taxes. In New Zealand self-employed and some businesses pay provisional tax, your guesstimate of how much you will owe them at the end of the year, paid in advance. Trouble is, if you're a consultant or the like whose income can vary considerably, you can end up overpaying. (Underpaying can come with steep penalties and getting on the wrong side of IRD's "good books" is not a bright idea.) Currently they owe me. Or rather, they need to give me back some of what I gave them earlier. (Of course, in between times they have had my money to invest and I didn't. Don't get me started on that...)

Good news indeed.

Since I paid my taxes in January, I'd lost track of the date. Good luck filing on time to all who still need to!

I owe nothing today, as approximately 15% of my monthly paycheck is withheld automatically by my employer, for federal income taxes. Of course there are other taxes to pay: property, sales, etc.

Well, you are smarter at handling your money than I am. I've got a refund coming. So I loaned that money to the government at no interest. I should have kept it in my pocket and bought stuff to sell on ebaY at a huge profit. I could have ended up sending the government even more tax money while still having profits in my pockets greater than my refund will amount to. Opportunity missed!

My canine Boss objects to the special treatment for scratching posts, and the lack of credit for tennis balls is simply unacceptable to him.

He would probably also object to some of the specific formulae, except that he doesn't bother to distinguish between any number higher than one and "many". In fact, since he delegates all paperwork to his staff (me), he declines even to provide nose or paw print - call it oblivious objection.

Damn! The Snookums Tax would KILL me!

But seriously, we were wondering where we'd get the money to pay what the tax software said we owed until I discovered that my DH had grossly underestimated my work-related mileage. Now we don't have to decide between the IRS and the mortgage company.

Ugh, tax forms, full of legalese that I don't know what certain stuffs precisely mean.