As with history in general, I suppose the victors write--or rewrite--economic history too. One of the arguments for balancing budgets that's floating around is that Clinton got us a surplus, times were good, and therefore, we should do it again. Of course, things were better for some people, including those at the bottom (which is a worthwhile gain), but most of the spoils went to those at the top. As the joke went, "Clinton has created millions of jobs, and I'm working three of them." Snark aside, the reason why Clinton was able to lower the debt was no mystery: private sector debt increased, and the trade deficit was relatively low. There was no 'virtue' involved, but simply the balance of accounts. That is:

Government deficit = Trade deficit + Total private savings

You can't beat the algebra. I've been through the evidence for this before, so let's just go straight to the consequences.

If we cut government deficits, then either the trade deficit has to drop, or we have to decrease total private savings. Put another way, if the trade deficit decreases due, let's say relatively low energy prices, and we give people the opportunity to rack up massive amounts of private debt, then we will lower budget deficits, or even have a surplus. Let's see what happened:

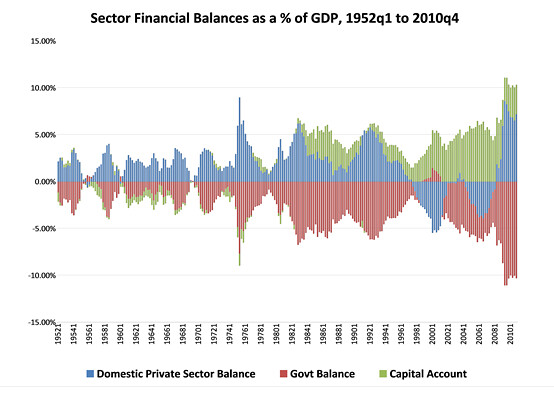

To walk you through this, the blue bar is the amount of private savings (all numbers are scaled to the size of the economy using GDP); a value above zero means that, on the whole, the U.S. has net savings. The red bar is the deficit; a value above zero means a budget surplus, a value below zero means a budget deficit. The green bar tells us about trade: a positive value means we are a net exporter, a negative value means we are a net importer (i.e., we are running a trade deficit).

So let's look at the halcyon days of Clinton (1997-1999). Yes, the budget was in surplus (the red bar is above zero). The trade deficit was much lower than it would have been had oil prices been where they were when Clinton took office, which helps lower the budget deficit (~50% higher in nominal terms, never mind adjusting for inflation). But the key point is that private savings plunged: during the Clinton era, we took on private debt at unprecedented levels (the blue bars). A lot of people seem to have forgotten that massive increase in personal debt (especially you whippersnapers).

The irony of the recent Elizabeth Warren non-confirmation is that Warren made her political bones by decrying this massive increase in debt, including household debt. While some of this debt was frivolous 'lifestyle' debt, a lot of it was either due to medical hardship or other emergencies (by the way, credit card debt is once again on the rise due to financial difficulties in middle class households).

On the other hand, if we look at the Great Compression--the 1950s through the 1960s--in which the middle class prospered, we see that the savings rate was high and associated with equivalently large deficits. But TEH DEFICITZ R EVIL!!! Or something.

I bring this up because--as I noted about the trade deficit--it is straightforward to reduce the budget deficit if you want to. Or more accurately, if you want to have high unemployment* and/or massive household debt, you can do this**.

You would suck as a human being, but it is very simple to do. Just follow what the Gang of Six are recommending.

This is why it's so frustrating to hear all the talk about how we should cut budgets, when there is no discussion of why we should do so. What worse is that people who call themselves progressives and liberals want to make the Clinton era argument. I understand the desire to score points, but it's lousy policy. And, in the long run, arguing that we should enact conservative policy, but just not right now is both bad politics and bad policy.

As I've written many times on this blog, deficits or surpluses per se are not bad, it's what you do to achieve them that matters. Deficits and surpluses have consequences. Other than the ludicrous case of showering people with money and shutting down the IRS (which would probably demolish the legitimacy of our currency), it's just a matter of accounting.

And scientists: Senator Coburn and his ilk always frame assaults on science funding in the context of deficit reduction. Just saying.

*Being unemployed is a great way to reduce savings.

**Like any politician would have the balls to tackle the trade deficit.

Another great post. Thanks for laying it all out.

MTMB: "The green bar tells us about trade: a positive value means we are a net exporter, a negative value means we are a net importer"

Surely you have this reversed? Or have we had a trade surplus recently?