economy

It was interesting to me that my comments that protesting the economy without also including elements of economic protest were taken to mean "I think Occupy Wall Street is bad." I still think that to be genuinely effective, protests of capitalism have to take into account what will replace it - and our own implication in the system, but I am happy to see the protests growing, and developing an emergent sense of possibility.

I think Jim Kunstler hit it on the head this week:

This is the funniest part to me: that leaders of a nation incapable of constructing a coherent consensus about reality…

Perhaps the first widely read piece I wrote was entitled "Peak Oil is a Women's Issue" and focused on the ways that an energy decline might affect women. At the time it was written (the earliest version appeared in 2004) the peak oil movement was largely a group of men, mostly geologists, oil men, a few economists and journalists interested in a growing issue.

My argument (more refined variations of which I've continued making for years) was that women need to organize around energy and environmental issues, because they stand to lose a great deal in a society that has fewer resources to…

Ben Bernanke has the answer. It is all your fault.

Then he said something new: Consumers are depressed beyond reason or expectation.

Oh, sure, there are reasons to be depressed, and the Fed chairman rattled them off: "The persistently high level of unemployment, slow gains in wages for those who remain employed, falling house prices, and debt burdens that remain high."

However, Mr. Bernanke continued, "Even taking into account the many financial pressures that they face, households seem exceptionally cautious."

Consumers, in other words, are behaving as if the economy is even worse than it…

If you have to accustom yourself to the end of growth, the Onion reassures us that it won't be too hard:

63 percent of Americans said they had come to rely upon the familiar sense of dread that came from knowing the country was quickly losing its place as an economic superpower, while 71 percent described finding a kind of tranquility in the steady, predictable cuts to local, state, and federal funding.

In addition, 80 percent reported they had been tightening their belts for so long, the thought of loosening them again after all this time just felt unnatural.

"You get used to sending 50…

- The basic Rogoff/Reinhart observation that financial collapses due to asset bubbles just take a long time to work through. Given the size of the 2008 collapse, historical evidence suggests that it's going to take five or six years to recover, and that's that.

- The Tyler Cowen "Great Stagnation" hypothesis. We've picked through all the low-hanging economic fruit over the past century, and like it or not, we're now entering an extended period of low productivity growth because we're not inventing lots of cool new stuff.

- The related (I think) investment drought hypothesis. Ben Bernanke…

We now all know the limitations of Standard and Poor, what they missed and what they didn't, why to blame Republicans, why to blame Obama, and that Austerity is the new watchword in the US, while rioting has taken everyone's imagination in the UK (wow, aren't we timely?) Most of us are worried that the US will slip back into a recession. You shouldn't be.

The reason you shouldn't be worried is that the good news is that the US was never *really* out of a recession. Sure, in economist terms, we technically had some quarters of growth and a nice extended stock market rally, but in the net,…

Ilargi at the Automatic Earth has a great big picture post on the real state of financial institutions and why we may be headed back to 2008 and bank bailouts again: Using his mock portfolio, he offers a very different picture than the one you'll get in the news:

As you can see, there are a number of stocks in there that not everyone would have in a finance portfolio, and some others that may be missing. But I like it this way. I still left Lehman and Fannie and Freddie in (though none are exchange traded anymore), and included GE and Société Générale, among others.

This portfolio shows…

I have a pretty good track record on the economic crisis. In 2007, I pointed out that the "slowdown" that people were saying was absolutely not a recession, was, in fact, a recession. In 2008, I pointed out that most major economic downturns of the past century haven't been very brief - although technically the 1970s economic crisis consisted of two recessions, rather than one, you could just as easily observe that it consisted of a decade or so of high unemployment, economic stagnation, etc...etc... I argued that it was likely that the major economic crisis we were finally acknowledging…

As I gear up to finish my Adapting-in-Place book, I've been thinking a lot about the role of the informal economy in supporting a culture that can't keep growing and consuming resources at the same rate. As those of you who have been following my work for a while know, the informal economy represents the larger portion of the world economy (3/4 of all economic activity) and includes a wide range of important activities. When the formal economy fails, the informal economy is needed - and yet we have stripped the informal economy over the last decades. How to rebuild is a huge question - and…

Every time oil prices get high, the SPR becomes a central issue. I really like Kopits' analysis here - I think he may be right that the impact of the SPR might hold off an oil shock. At the same time, the question is whether we would then be able to build it up again, and whether we face greater subsequent shocks.

The SPR holds 727 million barrels of crude oil, about 40 days of US consumption and 70 days of oil imports. In addition, the US has about 1.1 billion barrels of commercial crude oil inventories. All in all, the US has sufficient domestic crude oil stocks to cover about six months…

Some of you may know that a publisher contacted me last year about turning a piece of short fiction I'd written from an adult perspective into a young adult novel. There are several reasons I wanted to do this - the first is that in many ways, the young adult fiction market is much more vital than the adult fiction market - a lot of adults read YA fiction, while the reverse is rarely true. There's the potential to reach a large audience this way. The other, more important reason to me is simply that teenagers and young adults have to know about our future, and they need a vision of a…

Sundry stuff on a busy day - and a day when everyone is transfixed by world events.

First, my colleage at Dean's Corner has offered a good guide to high tech ways to donate money to Japan relief. There are 10,000 people in Japan who haven't eaten since Friday by the best estimation, and events are adding to the horror. If you want to help, these are some simple ways.

Second, the always thoughtful Kurt Cobb has a great essay everyone should read about the deflationary impact of high oil prices:

The logic is so simple it's hard to understand why smart people with advanced degrees can't see it…

I've had a number of emails recently, as I've written here, at The Chatelaine's Keys (Yes, I know the site is down - there was a billing mixup that required a fax to fix - we don't have one at home and we got a foot and a half of snow on Friday, too much to bother struggling out for. The blog will be back soon, now that Eric is at work where faxes are more prevalent than out here on the farm.) and on facebook about the process of preparing to foster and eventually hopefully adopt more children that asked what this had to do with peak energy and climate change.

I'm a little reluctant to…

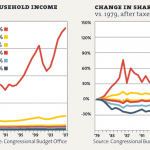

Mother Jones has a very clear visual presentation of the increase in economic inequity over the last years - 11 charts they say shows it all. I'm not sure it shows it all, but they are well worth looking at, particularly these two:

And this one, which shows the perception that Americans have - that things are much more equal than they are.

Ultimately, the same battles being fought in the Middle East are going to be fought here - because with an ever-shrinking pie in an economy that will struggle to grow because of a declining resource base, there's no other option.

Sharon

In yesterday's NY Times Op-ed, Kristof apologized for comparing US income inequity to that of "Banana Republics" - that is, for insulting other nations by comparing them to the US, which has now achieved wholly unprecedented levels of economic injustice.

My point was that the wealthiest plutocrats now actually control a greater share of the pie in the United States than in historically unstable countries like Nicaragua, Venezuela and Guyana. But readers protested that this was glib and unfair, and after reviewing the evidence I regretfully confess that they have a point.

That's right: I may…

The election is over and the results are depressing, much as expected - it was not a good night for anyone who believes that the most important work of government in hard times will be protecting ordinary people. This is a stretch to imagine at the best of times, and this was not them.

There's a larger question, however, that emerges out of the ashes of our usual political self-incineration - what will ordinary people will do with their fear now that the election is over?

Over the last few weeks, a series of articles have emerged that observe that the language of voter anger, so ubiquitous…

Like my colleague Mike the Mad Biologist, I'm horrified by a story out of Indiana in which parents of disabled children who are no longer receiving state aid due to the state budget crisis, were told that they could drop the kids off at homeless shelters if they were unable to care for them at home:

However, that's exactly what Becky Holladay of Battle Ground, Ind., said a bureau worker told her when she called to ask about the waiver she's seeking for her 22-year-old son, Cameron Dunn, who has epilepsy, autism and attention deficit hyperactivity disorder.

"We are people and they are people…

Super-quickie from me today - officially I'm in transit, but while my visiting my MIL and miraculously having time to read the entire New York Times before breakfast (admittedly the skinny Wednesday edition, but hey, I'll take it), I wanted to draw your attention to this article by David Leonhardt about how to think about housing.

Read the whole article - it is a good, basic overview of how economists generally view housing. What I'd like to write about it, but don't have time for right now (we hit the road shortly) is the way in which I think both of these viewpoints are inadequate to the…

A number of people, including Ilargi and Stoneleigh at _The Automatic Earth_ have long pointed out that the interventions that the government has made in the housing market hasn't served the people. They observe, for example, that by propping up house prices artificially they've benefitted more affluent, generally older homeowners, at the expense of younger, poorer people, renters and those who would like to get into the housing market but can't afford its (still) inflated prices. The problem with this, besides the generational and class screwage is that these strategies don't serve even…

Actually, it isn't all that slow, because a decade ago, all of this would have been largely unthinkable. The problem is that we don't see the gradual decline and fall - we are only vaguely aware that some things aren't quite what they used to be, and our progressive narrative tells us that they will soon be much better. But the problem is that's not necessarily true - there's little evidence for it. Even the most optimistic economists (and I don't recommend the most optimistic economists ;-)) have to admit our long term economic problems are extremely pressing. Add in resource depletion…