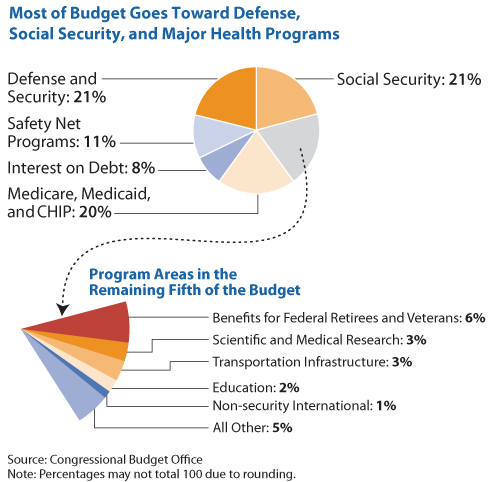

In light of the April 15 protests, I think this chart by the Center on Budget and Policy Priorities which describes the federal budget is appropriate:

You'll notice that the largest component of the budget is defense spending (it narrowly edges out Social Security), and unlike Social Security, there is no designated revenue stream (which incidentally has a surplus). Any discussion of budget balancing that does not consider defense spending is simply not serious. The other thing to note is that this does not include tax expenditures, the largest being the employer healthcare tax deduction of $134 billion.

As a British outsider, it absolutely amazes me that more Americans aren't livid about the amounts you spend on health and defense.

Expect that 8% that pays on the interest that ccrues on the Federal Debt to increase dramatically over the next couple of years.

All three major spending areas (62% of federal spending goes primarily towards five programs) need major overhauls. Social Security was never intended to do what it currently does, Medicaid and Medicare are laden with fraud, and the DoD needs to learn to do more with less.

We also pay separate medicare taxes, so really both Medicare and social security should be taken out of that pie.

The real crime is how little we spend on education. Where are all the problem solvers in the future going to come from if we short-change education?

Education has much, much more funding than appears in the chart. The chart is federal spending, education spending happens almost entirely at the state level. Texas, for instance, spends almost half of its $170 billion budget on education.

We also pay separate medicare taxes, so really both Medicare and social security should be taken out of that pie.

Nonsense, unless you think the Congressional Budgeting Office doesn't know what it's doing.

Science should stick to science (such as adaptation) and leave philosophy (which is what the theory of evolution and origins is) to the philosophers

The theory of evolution is philosophy? Are you serious? Please tell me you're joking. Please. Come on, you're joking.

Comparing budget repartition across countries is akin to comparing oranges and bananas, as long as the perimeter of the budget is not the same.

For example, I notice education weighs only about 2% of the budget. This obviously means that the teachers' wages are not paid by the US (who pays them: each state?).

For example, here in France, as teachers are civil servants, their wages end up making a significant part of the budget. But health is much lower (because healthcare and pensions are not managed by the state, they have their own taxes).

The same is true about comparing tax rates across the world: this is something the right in France does quite often, because as our tax rates include healthcare and pension fees, they show up significantly higher than most others.

TomJoe - The Congressional budget office know what it's doing alright. For years, it has been using the surplus in the social security fund to make the deficit in the rest of the budget seem smaller. There are very good practical reasons for taking social security and medicare out of that pie since they are separate funds. The CBO is a political animal and, although officially non-partisan, politicians of both parties are happier when the budget looks more balanced than it is.