So Ezra Klein, along with many other progressives, has been offering alternatives to the Republican call for the slash-and-burn of Social Security. But what's annoying about all of this is that the prediction that Social Security revenues plus the accumulated U.S. securities (yes, the U.S. government, not China, is far and away the world's largest holder of U.S. securities) will be unable to meet its obligations in 2037*, and only pay out 78 percent of benefits. That estimate comes from a Congressional Budget Office (CBO) report (pdf). But that CBO estimate is based on an annual real GDP rate of growth of 2.5%.

Zoiks! OK, I realize those of you who have managed to stick it out this far might not understand the implications of what a RGDP rate of growth of 2.5% implies (heathens!).

That rate would be so historically abysmal that, since going off the gold standard, we have never had a thirty year period with an average rate of growth of 2.5%. Ever.

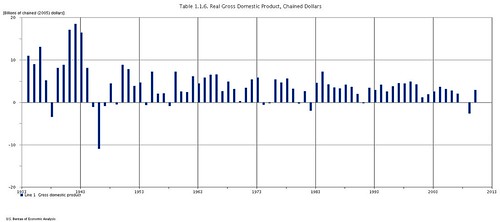

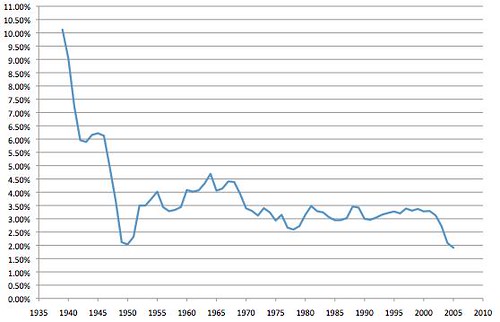

In other words, this is a dreadfully pessimistic estimate. How bad is it? Well, let's first look at the annual rates of 'chained'** GDP growth in the U.S. since 1932:

Yes, there are some bad years, but since 1932, the average rate of annual GDP growth** is 3.4%. From 1949 on (Truman's second term), it's 3.2%. But let's look with a wider lens: an eleven year average (i.e., the rate for 2000, would average the increases from 1995-2005):

Here, there are only five 'eleven-year windows' out of 67 that fell below 2.5%--and three of those overlapped with the post-WWII slump. And two overlapped with the Collapse of Big Shitpile (it's worth noting that in 2010, even with a crappy economy, GDP growth still was higher than 2.5%). Other than that, GDP growth is much higher than 2.5%. In fact, as Dean Baker has been noting for over a decade, it's high enough that Social Security is 'solvent' in perpetuity without any changes.

The real crisis is that, if Social Security is unable to meet its obligations, the U.S. economy will have horribly underperformed for 27 years. And even if that ahistorical scenario comes to pass, we can still solve the problem with tax increases then (which would be considerably lower than the two previous increases, which increased the tax by 100% and 50% respectively). Alternatively, we can remove the cap on income today*** and the problem essentially vanishes.

While putting this together, I saw that Dean Baker made a similar point, but about the general budget (italics original; boldface mine):

In the spring of 1996, the non-partisan Congressional Budget Office (CBO), whose numbers are taken as being authoritative in Washington, projected that the government would have a deficit of $244bn in 2000, or 2.7% of GDP (pdf). Instead, the government actually ran a budget surplus in 2000 of almost the same size. This amounted to a shift from deficit to surplus of more than 5.0 percentage points of GDP; an amount that is equal to $750bn given the current size of the economy.

The reason for picking the spring of 1996 as the starting point is that this is after President Clinton's tax increases and spending restraints were all in place. It was also after all the spending restrictions put in place by Gingrich Congress had already been passed into law. In other words, the CBO knew about all of the deficit reduction measures touted by both political parties and it still projected a $244bn budget deficit for 2000. Furthermore, the changes to the budget in the subsequent years went the wrong way. According to CBO's assessment, the legislated changes between 1996 and 2000 actually added $10bn to the budget deficit.

The trick that got us from the large deficit projected for 2000 to the surplus that we actually experienced in that year was, in fact, much stronger than projected growth. CBO projected that growth would average just 2.1%. It actually averaged almost 4.3%. Instead of ending the period with an unemployment rate of 6.0%, unemployment averaged just 4.0% in 2000.

It's the GDP growth, stupid. That's what we need to be focused on, not ridiculous underestimates of economic growth leading to cries of DOOM! for Social Security.

An aside: Whenever I write about GDP growth, someone shows up and claims that GDP growth is environmentally unsustainable. Wrong. Imagine if we made a massive shift over to clean energy, a vastly more efficient power grid, and so on. This would massively increase GDP, in much the same way that the rebuilding after natural disasters can actually increase GDP growth.

*Of course, over the last 25 years we have predictions that Social Security will become 'insolvent' 25 - 38 years from the date of the estimate. That should give you pause about the gloom and doom estimates. Or you're a fucking moron.

**This is GDP normalized to a certain year, but due to really some obscure technical shit that I'm not interested in writing about, comparing absolute values from different years is tricky; however, year to year differences aren't a problem. This is why I'm averaging 'windows' of GDP growth.

***The payroll tax is regressive, in that income above a certain level is untaxed.

Some calculations here:

http://www.thefiscaltimes.com/Columns/2011/05/11/The-Job-Delusion-Growt…

2.75 versus 2.50 percent growth is a culuclative GDP diff of 395 trillion over 75 years. Way more than enough to fix the problems.

At the risk of redundancy, GIGO, GIGO, GIGO!

I'm a failed biologist turned economist (beats unemployment). You seem interested in economics too. Yes 2.5% is absurdly low for the USA. On the other hand 2010 could have been a year of bouncing back from the recession. It would have been too if the stimulus were twice as large. Not that I have anything (else) against the stimulus bill. It was followed by the most rapid acceleration of GDP growth over 2 quarters since 1980 and also the most rapid acceleration of GDP growth over 3 quarters since 1980.

Note 1980 => President Carter (Volker was trying to save him and paused his ruthless recession for the election proving that he really is a Democrat which I doubted until then).

OK back on topic. Good to tell people about Baker. He has the goods on the doomsayers. The point is that there are positive surprises almost every year, so the trustees' "Low cost" estimate such that the program is solvent fits the data and their middle cost estimate has been pessimistic. The trustees tend to be even more pessimistic than the CBO.